A Personal Loan serves as a solution for funding emergencies or covering shortfalls in expenses, such as family celebrations, weddings, or holidays. Additionally, Personal Loans are unsecured and may be used for home renovations and educational costs. When Applying for a Personal Loan, the applicant must ensure that the amount applied for is well within the repayment capacity to avoid future delays or defaults.

HDFC Bank Offers Personal Loan amounts ranging from ₹1 Lakh to ₹50 Lakhs for salaried individuals, depending on the net income and other obligations. The loan amounts are generally determined based on a customer’s monthly income and their ability to pay the monthly instalment.

An applicant can apply for the loan amount required however, the criteria for approving the funds issued as an HDFC Bank Personal Loan for Salaried Employees are governed by HDFC Bank’s Policy. By segmenting the performing ratio, HDFC Bank allocates funds based on the following criteria:

Company Category According To The HDFC Bank Company Category List:- Your employer must be featured in the Approved List of Companies of HDFC Bank to process a Personal Loan. The HDFC Bank classifies companies into A, B, C, and D based on their net worth, turnover, and prospects. Their listings on the stock exchange and the Economic Times 500 list, as well as Government-Funded and publicly owned undertakings (PSUs), are included in the preferred list.

Employees of premium companies, included in the CAT A and CAT B company categories, are predicted to have a steady income and stability of employment and are granted higher loan amounts with more favourable terms compared to those employed by a CAT C company. According to HDFC Bank’s policy, the loan amount and tenure allotted to lower-category companies are capped.

For example, Ravi, who works in a Category A company and receives a monthly income of ₹50,000, is eligible to receive a loan amount of ₹15 lakhs. In contrast, Parul, who earns an income of ₹50,000 but is employed with a CAT C company, is eligible for a maximum amount of ₹10 lakhs.

Net Income:- The net income is a significant factor that affects the monthly EMI you can afford to pay for the loan amount. The income segments are divided according to the net income:

Applicants with an income of ₹75,000 or more are classified in the elite category and are eligible for unsecured Personal Loans of ₹15 Lakh or above from HDFC Bank.

The minimum salary requirement is ₹30,000, which must be deposited into the bank account every month via electronic transfer. The percentage of the income allotted by HDFC Bank towards the EMI increases in proportion to the salary received, as per the applicable multiplier. A higher income indicates that the applicant has more disposable funds at hand and can afford to pay a higher monthly EMI for a Personal Loan.

HDFC Bank Personal Loan CIBIL Score and History:- HDFC Bank is among the leading lenders offering Personal Loans without a Credit history. If the applicant is a first-time borrower, the bank will offer lower loan amounts, providing the applicant with the opportunity to establish a credit history.

For existing credit users, a CIBIL Score of 730 or higher is required to process a Personal Loan from HDFC Bank. HDFC considers the applicant’s credit history and current EMI when determining the loan amount. A strong repayment history of existing loans encourages the Bank to approve the requested loan, while delayed repayment and bounced payments may lead to rejection.

Before finalising the loan amount, the CIBIL record is checked for existing credit and the EMI being paid by the applicant. This includes all mortgages, loans against commodities and credit card spending. If the existing obligations exceed the percentage of income allotted toward credit, the customer is declared overleveraged, and the Personal Loan Request is Rejected.

HDFC Bank also notes the number of inquiries in CIBIL when reviewing the applicant’s credit record. If there are too many recent inquiries, it indicates that the applicant has applied for credit simultaneously to multiple financial institutions.

Excessive inquiries are viewed negatively because they suggest the applicant may be under financial stress or trying to secure funds from multiple banks, which may indicate an inability to repay the loan on time.

Credit Cards are convenient spending tools that allow users to utilise funds within the assigned limit and make repayments after a grace period of 45 to 50 days. A statement detailing the expenditure is sent to the customer for repayment on the due date. If unable to pay the full amount, a payment of 5% or the minimum dues must be made. The remaining balance is carried forward to the next cycle, subject to a finance charge of 36% to 42% per annum.

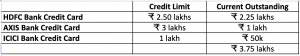

Applicants with unpaid Credit Card dues may face high interest rates. If there are outstanding balances on multiple cards, it may indicate that the applicant is experiencing financial difficulties. Therefore, the CIBIL Report is reviewed to determine the number of Credit Cards the customer holds and any pending dues. The HDFC includes 5% of the pending dues in the customer’s obligations. If the total due on the Credit Cards exceeds 5 times the customer’s income, the request is declined. For example:

Dinesh earns a monthly net salary of ₹ 40,000. He holds Credit Cards from HDFC Bank, ICICI Bank, and Axis Bank with the following details.

As per the above details, Dinesh has a current outstanding of three lakhs seventy-five thousand across all three cards. With an annual interest rate of 36%, the applicant will be charged ₹ 1,35,000 annually or ₹ 11,250 per month as interest.

Besides the principal factors such as the Income, Company Category, and the CIBIL Score, the other factors taken into consideration include:

The Applicant’s Age:- Young applicants aged 23 or older who have recently been employed and are first-time loan seekers are offered a limited amount as a Personal Loan. Applicants above 53 years of age are offered a Personal Loan From HDFC Bank with a repayment tenure based on their remaining years of service.

An HDFC Bank Relationship:- Personal Loan applicants who have a salary account with HDFC Bank, or an existing loan or Credit Card, and have a proven track record of timely repayments are eligible for higher loan amounts.

Co-applicant Benefits:- HDFC Bank accepts spouses or parents as financial co-applicants. If a customer’s loan amount needs exceed what they can afford with their current income, the co-applicant’s income is added to boost eligibility. The co-applicant must meet the Eligibility Criteria of HDFC Bank terms and conditions to be accepted as a co-applicant.

The maximum loan amount an applicant can receive from HDFC Bank depends on the profile, net income and the percentage of revenue that the applicant can dedicate towards repayment or the monthly EMI.

Applicants can request a lower amount after a Personal Loan is Approved however, if they do not receive the required loan amount, they can request a relook, but this may mean they are not eligible for a further amount.

The repayment tenure for an HDFC Bank Personal Loan ranges from 12 months to 72 months and is allotted according to the applicant’s eligibility to pay the EMI. A shorter tenure will lower costs, but a longer tenure will allow the applicant to get increased funding.

Using the EMI Calculator, applicants can calculate the EMI for the required loan amount, which helps them determine a suitable loan amount and tenure for their application.

An applicant can reapply for a Personal Loan to HDFC Bank after 30 calendar days.

An applicant can increase the Eligibility for a Personal Loan by repaying credit card bills due and by Applying for a Balance Transfer of an external Personal Loan to HDFC Bank.

An applicant can apply for further Personal Loans to HDFC Bank after suitable intervals; the loan amount issued will be according to the applicant’s existing profile, CIBIL score, and existing obligations.

To qualify for an HDFC Personal Loan of ₹ 20 Lakhs, an applicant must meet the following eligibility criteria:

To Receive a Personal Loan Amount of ₹ 10 Lakh, The Applicant Must Fulfil The Following Criteria:

An applicant employed by a CAT D Company is eligible for a maximum Personal Loan of ₹ 15 Lakhs from HDFC Bank.

With a bid to gain a spot among the top lending brackets, YES Bank has opened up tremendous opportunities in the retail lending and banking sector with a comprehensive and customer-friendly approach. It has fostered a stable and progressive environment for the salaried class to meet their financial needs whenever required with a Personal Loan from YES Bank.

The YES Bank Personal Loan Eligibility Criteria make funds easily accessible and affordable for the salaried class. Listed below are the reasons that position YES Bank as your preferred lender for Personal Loans compared to other banks.

CIBIL Score Requirement: The CIBIL requirements for lenders have become a standard for most banks when processing personal loans. A CIBIL Score of 720 to 750 Points is mandated according to the specific eligibility criteria of the bank or NBFC. For instance, to fulfil the ICICI Bank Personal Loan Criteria, the applicant’s CIBIL Score should be 750 or higher.

The YES Bank Personal Loan CIBIL Score: The acceptable CIBIL Score for a YES Bank Personal Loan is 700 points or above. If you have not been able to use a Credit Card and your CIBIL Score has actively remained around the 700 mark, you may still be eligible to apply for a YES Bank Personal Loan. The condition is that there must not be more than three inquiries in your CIBIL record to avoid multiple borrowings.

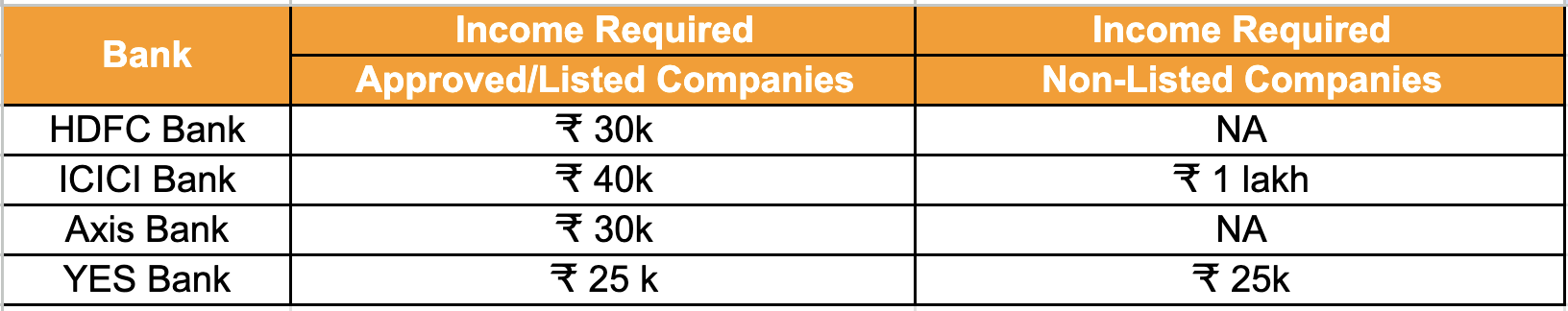

Criteria for Personal Loans with Listed Companies: A Personal Loan Application for HDFC Bank is processed only if the applicant’s company is listed on HDFC Bank’s Approved Companies List. Similarly, the Eligibility Criteria for Personal Loans at ICICI Bank also require the applicant’s employer to be included in ICICI Bank’s List of Approved Companies. Additionally, NBFCs usually charge higher interest rates to applicants who are employed by non-listed companies.

The YES Eligibility Criteria for Employment: The YES Bank publishes a comprehensive list of approved companies for sourcing personal loans. Companies are categorised as CAT A, B, and CAT C according to the priority for lending, with CAT A being the preferred category. The YES Bank is the only primary Bank that entertains personal loan applicants from non-listed companies. If the company meets YES Bank’s Loan Eligibility Criteria, it is listed under the relevant category. Therefore, applicants working with non-listed companies need not despair the YES Bank Personal Loan for Salaried Employees is available to them if their company meets the YES Bank Personal Loan Eligibility Criteria Check.

Income Criteria For Salaried Employees: The minimum salary required to process a Personal Loan from HDFC Bank is ₹30,000, which must be transferred to the bank. ICICI Bank requires a minimum salary of ₹40,000 for applicants employed by listed companies. Most lenders issue personal loans to high-income applicants, with no flexibility regarding the salary transferred.

YES Bank Personal Loan for Salaried Employees: The YES Bank Personal Loan minimum salary requirement is ₹ 25k and above, which is more reasonable compared to other Banks. The lower salary parameter enables applicants who are earning a basic salary or have just started their career to borrow funds for personal use via a Personal Loan at YES Bank. The salary criteria are acceptable across company categories as per the YES Bank Company Category List.

Apply for a YES Bank Personal Loan Online: YES Bank offers a comprehensive online processing facility for Personal Loan applicants. Documents can be uploaded online with the details required for the YES Bank Instant Personal Loan.

YES Bank Personal Loan Interest Rates: The interest rate charged for a YES Bank Personal Loan varies according to the approved loan amount and the applicant’s company category. The minimum interest rate is 11.50%, with a maximum of 16%.

Maximum Loan Amount: Personal Loan amounts of up to ₹50 lakhs are available to eligible applicants employed in a category A company. Multipliers determine the loan eligibility based on the company’s category. Applicants can calculate a suitable EMI using the YES Bank Personal Loan EMI Calculator.

A Personal Loan from YES Bank caters to the entire salary segment and offers unsecured funds for various personal and emergency needs. The approved loan amount is transferred to the account and can be used as needed, providing the loan holder with the freedom to utilise the funds as desired. With numerous benefits offered, the instant online YES Bank is now the preferred Option for a Personal Loan.

Personal Loan Request Decline Reason: The customer is overleveraged (does not meet the eligibility criteria of the Bank). Here is a comprehensive explanation of how we assisted him in obtaining the required loan amount after the Bank had declined the request.

The Customer’s Predicament: Nitesh Sharma, a young professional with a management degree, is employed in the insurance sector. He applied for an HDFC Bank Personal Loan of ₹3 lakhs, as he was falling short of funds for his wedding expenses, the date was approaching, and arrangements needed to be made. He was confident of getting the amount as his CIBIL Score was above the acceptable benchmark.

Therefore, it came as a surprise to him when his application was declined as being ‘overleveraged”. A customer is considered overleveraged if the Bank believes that the applicant, with their existing obligations, will be unable to afford further credit.

Steps to a Solution: Nitesh reached out to us by completing the Personal Loan Request form on our website. When our loan advisor contacted him for clarification, he was forthcoming about the issue he had encountered.

Listed below are the profile details of Nitesh Sharma that are considered for a personal process.

Calculating Eligibility: Most banks employ the FOIR (Fixed Obligation against Income Ratio) method to determine loan eligibility. Based on the income and the company category listed in CAT B as per the HDFC Bank Company Category List, he is eligible to allocate 50% of his income towards credit dues.

As of the current status, he was paying an EMI of ₹ 25,093, which was declared insufficient for an additional loan amount. Therefore, his HDFC Bank Personal Loan Application was declined.

The Answer: According to his profile specifications, he is eligible to Apply for a Personal Loan. He shared the necessary Personal Loan Documentation with us, which includes the KYC and income documents. The documents were all in order, and upon reviewing the bank statement to match the incoming and outgoing payments, we noted that he was paying an EMI for a home loan.

Finding a way to assist him in securing the necessary funds was urgent because he had already earmarked them for the forthcoming celebrations. We reviewed the specifics and inquired about the details of his credit and found the answer.

A home loan is always granted with a co-applicant, and in Nitesh’s case, this was his father. Furthermore, according to policy, if the co-applicant is an earning member, half of the EMI for a home loan is allocated to them.

We requested that he submit his father’s KYC and bank statement, and we subsequently submitted his Personal Loan Application to ICICI Bank, along with the necessary documents for processing. After allocating 50% of the Home Loan EMI to his father’s account (₹ 12546.5), he is now Eligible for a Personal Loan based on the following eligibility calculation.

Thus, following the submission of his father’s proof of documentation, his Eligibility for a Personal Loan was established, and he was granted a Personal Loan of ₹ 3 lakhs from ICICI Bank. He had calculated the applicable EMI in advance using our EMI Calculator and was satisfied that the EMI would be easily affordable.

Nitesh was relieved that he had managed to acquire the necessary funds on time, and assisting our customers in obtaining their desired funds is the goal we strive to achieve.

In conclusion, when a loan seeker contacts us, our first step is to understand the customer’s profile, their requirements, and their credit history. In contrast, banks assess the case based on the available documentation and the applicant’s data.

We strive to find ways for customers to obtain the necessary funds to address emergencies or immediate needs. The satisfaction of helping applicants meet their financial obligations is immense. Our years of experience and in-depth understanding of the Personal Loan Process provide a valuable asset to our customers, enabling us to offer innovative solutions that consistently exceed expectations.

AXIS Bank has established a legacy of consistent growth and is synonymous with trust, offering a range of banking and retail finance services, including secure and unsecured loans.

Personal Loans from AXIS Bank are easily accessible and disbursed with speed. Over the years, the AXIS Bank has created a niche for itself in the Personal Loan segment. As Personal Loans are provided without security, the Bank must ensure that repayments are received promptly. To this effect, an applicant must fulfil the eligibility criteria to obtain a Personal Loan from AXIS Bank. Listed below are the AXIS Bank Personal Loan Eligibility features:

The applicant must be over 23 years of age and may repay the Personal Loan until the age of 62. They must be gainfully employed, earning a regular income, and have at least two years of work experience. The Axis Bank Personal Loan minimum salary requirement is ₹25,000 or more, as per the Axis Bank Personal Loan Eligibility Criteria.

Employment Criteria: The applicant’s employer must be listed in the AXIS Bank Company Category of Approved Companies for sourcing Personal Loans. If you hold a salary account with AXIS Bank, your request is processed if you are employed with a Non-Listed Company.

CIBIL Score and Credit History: The applicant’s CIBIL Score must be 750 points or above, and there should be no significant aberrations in their CIBIL History. If the Axis Bank Personal Loan Eligibility CIBIL Score is above the required benchmark and the Application score is met, the applicant is processed further.

Application Score: AXIS Bank has its eligibility criteria and provides an application score online once the customer details are submitted. If the system approves the application, the process will continue otherwise, the request will be denied.

Loan Amount: The loan amount is calculated based on the applicant’s net income and current obligations, including EMI payments for other loans and Credit Card debts. The method used is the FOIR, or fixed obligations against the income ratio.

Illustration of a Calculation as Per the FOIR Method

The applicant is eligible to pay an EMI of ₹ 5,000 per month. By using a Personal Loan EMI Calculator, applicants can select a suitable tenure and verify their Personal Loan Eligibility. According to the specifications above, the applicant qualifies for a Personal Loan amount of ₹ 225000/- with a repayment tenure of 60 months.

Interest Rate for Axis Bank Personal Loan: The Interest Rate for a Personal Loan from AXIS Bank is issued based on the following.

The company category of the applicant’s employer, according to the AXIS Bank Company Category List, is classified as follows: Cat A is the premier category, Cat B includes other limited and government organisations, and Cat C features other eligible companies.

The Personal Loan amount approved by AXIS Bank carries an interest rate starting at 10.69% on a diminishing balance for loans of ₹15 lakhs and above, available to applicants employed by a CAT A company. In contrast, an applicant employed by a CAT C company is offered an interest rate of 15% for a loan of ₹2 lakhs.

The Axis Bank Personal Loan Interest Rate for salary account holders is discounted, and the best terms and conditions are offered to those with a vintage salary account at AXIS Bank.

Personal Loan Balance Transfer: AXIS Bank offers to take over an existing Personal Loan via a Balance Transfer. The eligibility criteria for a Personal Loan Balance transfer to AXIS Bank are as follows:

Personal Loan Top-Up: Existing AXIS Bank Personal Loan holders can apply for an additional amount as a Top-Up to their existing loan, subject to the following terms and conditions of the AXIS Bank Personal Loan Top-up Eligibility.

Personal Loan offers from AXIS Finance: AXIS Finance, a wholly owned subsidiary of AXIS Bank, offers Personal Loans to customers who are not able to meet the Eligibility Criteria of Banks. The assistance provided by AXIS Bank is as follows.

CIBIL Score Below 750 Points: AXIS Finance accepts applications for a Personal Loan with a CIBIL Score of around 700. Helpful for applicants who have not been using credit extensively or have been unable to build a Credit Score due to other reasons, unless the applicant is a defaulter or has current payment bounces. AXIS Finance considers the case on its merits. The applicant must fulfil the eligibility criteria of AXIS Bank Personal Loan Eligibility for salaried individuals.

Balance Transfer of Credit Card Dues: An overdue Credit Card bill attracts a finance charge of 36% to 38% per annum. If unable to pay the amount, it can spiral and lead to a debt cycle. AXIS Finance offers a personal loan for paying Credit Card dues. With a reasonable interest rate and a suitable tenure, Credit Card dues can be paid with a Personal Loan. This offer is available to applicants whose profile meets the Eligibility Criteria of AXIS Finance.

AXIS Bank is now competing with leading retail lending providers, such as HDFC Bank and ICICI Bank, by offering applicants the ease of processing and the convenience of an AXIS Bank Personal Loan Eligibility Check Online. The Axis Bank Personal Loan Eligibility Calculator integrates these inputs, which encompass individual, professional, and financial aspects. Fulfilling this criterion is essential to process an application for an AXIS Personal Loan.” At Yourloanadvisors.com, we strive to provide comprehensive information to our valued customers about the factors that influence Eligibility for a Personal Loan from AXIS Bank.

The CIBIL Score of an individual has become a universal requirement for issuing all kinds of credit. A Credit Score of 720 to 750 Points is a stepping stone to receiving secure and unsecured credit, such as a mortgage, Personal Loan, and a Credit Card. Though a CIBIL Score has become popular as a benchmark, your credit history or CIBIL Record is equally or more important, as it is the basis for calculating your CIBIL Score. There could be a situation where the CIBIL Score is around 730, but the request for a Personal Loan is declined due to aberrations in the credit history. Analysing the CIBIL Report vs Credit Score will help us further understand the functions and implications.

A CIBIL Score is a numeric value issued to an individual by CIBIL (The Credit Bureau of India Ltd), signifying the individual’s creditworthiness. The score value ranges from 300 to 900 points and is issued based on the following:

Banks require a CIBIL Score of 750+ points to issue a Personal Loan, though the CIBIL Score must meet the requisite benchmark both the CIBIL Score and CIBIL or Credit History are checked before issuing a Personal Loan.

The Transunion CIBIL (Credit Bureau of India Ltd) commenced operations in India in 2007. It was the first credit agency to initiate the recording and maintenance of individuals’ and companies’ credit usage. Credit issuing organisations, including banks, NBFCs, and finance companies, forward data on credit issuance and repayment on an ongoing basis to CIBIL.

The CIBIL, in turn, maintains an exhaustive record under the customer profile specifications. Upon inquiry, this data is shared with Banks whenever a customer requests a credit.

So, ever since it started operations, your credit history, whether taken as a Loan or a Credit Card, and the number of times you applied for credit are included under the profile created and the control number issued. A Credit Report or history is updated within a week or fifteen days after a lender reports a credit activity. A CIBIL History contains the following information:

Implications:- The EMI being paid and the outstanding Credit Card balances are taken into account when calculating the financial eligibility for an additional loan amount. The applicant’s existing obligations, net salary, and company category according to the Approved List of Companies are the main factors used to determine Personal Loan Eligibility.

Implications:- The closed accounts reflected in the applicant’s CIBIL History are evidence of adept financial management and add value to the Credit Score. The length of the account is also significant as it certifies that the user has been able to maintain a steady repayment schedule. A financer with credit that a customer has successfully used will be ready to issue further credit when required.

Implications:- A pending account is akin to a thorn in the flesh the amount will accrue interest until it is fully paid, adversely affecting the CIBIL Score. If there is a dispute or an incorrect entry in CIBIL, the customer can bring the matter to attention and seek clarification. The applicant must settle the outstanding dues before any credit can be granted.

Implications:- According to CIBIL, a written-off or settled account is regarded as a negative remark, resulting in a dip in the score, and the customer will not be granted further credit. Customers may have the misconception that paying the original amount and availing themselves of a settlement option will help alleviate the pressure and clear the debt however, this is not the case. A settlement will only offer relief from collection agents, but the CIBIL is marred forever.

Implications:- A payment delay due to a shortage of funds or an oversight cannot be mitigated and is always reflected in the CIBIL History. An infrequent delay in payments is overlooked, but a continuous string of delays will affect the CIBIL Score and give the impression that the applicant is not vigilant about paying dues on time.

Implications:- Banks and NBFCs must send customer data to CIBIL every fortnight. If the CIBIL Report indicates that the applicant has made multiple queries quickly, the Credit Score decreases by 10 to 15 points with each inquiry. Banks are also wary of extending credit to customers who may seek funding from multiple institutions and struggle with repayment. Your application for an ICICI Credit Card is declined if there are more than five enquiries reflected in your CIBIL, and your Personal Loan Application to HDFC Bank can get rejected due to multiple enquiries. Therefore, please do not apply to too many lenders simultaneously, as it can hamper your credit standing and give a wrong impression to the lender.

Banks will examine your credit history to gauge your credit management skills. This may surprise many who applied for a home loan a decade ago or briefly used a Credit Card without notifying the lender of their discontinuation of its use. There may be outstanding dues reflected in the account that could be a deterrent. A CIBIL Score above 730 points can initiate your Personal Loan Process, but a valid explanation is required if there are any irregularities in your credit history.

CIBIL History:- Your credit report or history, which lenders review, includes all credit usage from when you first acquired credit to the present. Once an entry is made, it cannot be altered or removed unless the lender updates it or there is an error in the Credit Report that is corrected.

Credit Score:- Your Credit Score is reassessed based on constant usage and the corresponding entries in your CIBIL record. It will increase or decrease according to the individual’s credit behaviour. For instance, if you limit your Credit Card usage and do not utilise any other form of credit, your Credit Score will remain steady. However, your score will change if you Apply for a Loan or resume using your Credit Card while making timely payments.

CIBIL History:- Your Credit History features years of credit usage, including repayment tracks and current credit. As per the recent Reserve Bank of India directive, Banks will now consider a credit history of 5 years instead of 7 as was previously done for the issuance of further credit.

CIBIL Score:- Your Credit Ratings will improve with credit usage. If you are a current credit user with a good mix of unsecured and secured credit, your CIBIL Score goes up accordingly. In contrast, if there is a delayed payment or current bounce in your record, the CIBIL Score will immediately reflect the same.

Credit History:- Your Credit History shows the EMI you are paying for all your existing loans and Credit Cards. If your credit card balance is unpaid more than your monthly income, and the total EMI you are paying will exhaust more than 60% of your income, your request for further credit is rejected due to being overleveraged.

CIBIL Score:- If you are paying the EMI for your loan on time and the minimum due on your Credit Card Bills, your CIBIL Score will not dip unless you apply for credit several times, and the credit inquiries reflect in your CIBIL History.

Today, lenders are delving into the applicant’s credit history to examine past credit dealings before issuing a Personal Loan. It is a good idea to solve past situations when your obligations could not be fulfilled due to financial shortages, as banks remain open to negotiation. If there have been delays due to unusual circumstances, as in the case during COVID, when many faced a financial crunch due to loss of employment, a leeway can be given. Otherwise, making amends by clearing outstanding dues will stand you in good stead.

Check Your CIBIL Score and credit history regularly, as you are entitled to a free Credit Score and a Credit Report from CIBIL. A CIBIL Score above 750 points signifies healthy credit usage. It is the benchmark used by lenders as a scoring model and gives applicants the indication that their finances are in good shape.

Our past credit dealings are a window into your future credit behaviour. Therefore, a sound credit history will help you obtain credit easily when required at the lowest interest rate, the most suitable terms, and an optimum CIBIL Score.

A Personal Loan is commonly used to fulfil lifestyle needs most salaried individuals prefer to apply for one as it is processed quickly and conveniently. Banks and NBFCS provide unsecured Personal Loans to borrowers to meet individual requirements, with terms and conditions applicable to the specific policy. Over the years, ICICI Bank has emerged as the preferred personal loan lender, offering a streamlined online process that ensures a hassle-free experience. Need a Personal Loan? Let us explore why ICICI Bank is the primary choice for Applying for a Personal Loan.

An individual’s CIBIL Score has become a vital mandate for securing credit, a Personal Loan, and a Credit Card. Banks are apprehensive about issuing unsecured credit to applicants who have not used credit and do not have a CIBIL Score. The ICICI Bank, with its robust lending track, also forwards loans to applicants who are first-time loan seekers and do not have a CIBIL Score and history. If you have a CIBIL record, you must have a CIBIL Score of 750 and above to secure a Personal Loan or Credit Card.

If you want to increase your loan amount for personal needs, Apply to ICICI Bank. ICICI Bank offers enhanced loan amounts to Prime applicants earning a salary of ₹ 1 lakh and above. The maximum loan amount of ₹ 50 lakhs is available as an unsecured loan to customers under the most favourable terms. The calculations for loan amounts are more comprehensive than those of other banks. For example, ICICI Bank considers the total net salary transferred to the bank account each month, which includes narrations such as the monthly bonus, which other Banks do not include in the calculation for eligibility for the loan amount.

Receive your Personal Loan funds within 48 hours with prioritised processing from ICICI Bank. ICICI Bank is the premier institution to have initiated a completely online application and processing system for Personal Loans. Now, applicants can apply and receive funds in the comfort of their home or office by filling out the application form online and providing soft copies of readily available documentation.

The Bank will conduct a document and CIBIL check digitally. KYC (Know Your Customer) is completed via a video call. The applicant must present the original KYC Documents, such as Aadhaar Cards and PAN Cards, and verify their signature. With all customer information accessible online, the ICICI Bank credit team approves the request within 48 hours.

The ICICI Bank Personal Loan policy encompasses customers from all segments meeting the Personal Loan Eligibility Criteria.

ICICI Bank has an extensive list of premier companies categorised as Elite, Prime, Super Prime, and Preferred. Most banks provide personal loans to employees of these organisations. Suppose you are employed by a company that does not appear on the approved list. In that case, ICICI Bank is the foremost financier offering Personal Loans to Non-Listed Company Employees. The loan amount issued is according to the customer’s net salary and obligations, without restrictions on employment in a non-listed company.

When you Apply for a Personal Loan at ICICI Bank, you can expect the lowest interest rate, starting from 10.99%. The processing fees are a one-time charge deducted from the loan amount on disbursal of funds. An agreement is sent for the customer to acknowledge, with the terms of the loan including;

The Personal Loan agreement clearly outlines all applicable charges, with no hidden fees. ICICI Bank offers 24/7 assistance through the toll-free customer care number 1800-1080. Customers can also address their queries to customercare@icicibank.com.

ICICI Bank issues a personal loan in various formats tailored to the customer’s requirements:

Personal loan Top Up: ICICI Bank values the relationship with existing personal loan customers. If surplus funds are required, the amount needed is issued as a top-up to the existing personal loan. With a Top-up Personal Loan, the applicant is offered the best-in-class interest and is comfortable paying a single EMI for the total loan amount.

Personal Loan Balance Transfer: ICICI Bank offers to take over a customer’s personal loan from another lender, paying a higher interest rate. Customers with a CIBIL Score of 750 points who pay the EMI on time receive a lower interest rate and discounted processing fees. With a Balance Transfer, the applicant can apply for an extra loan amount and restructure the loan for a longer repayment tenure.

Parallel Loan: Are you currently using a Personal Loan from ICICI Bank? ICICI Bank offers additional personal loans as a parallel loan to customers who successfully manage their existing personal loans and seek extra funds. The Parallel Loan functions independently of the existing loan, and the additional loan is granted if the applicant has the financial capacity to pay an extra EMI and meets the bank’s eligibility criteria.

In summary, ICICI Bank Personal Loans suitably assist customers with funds for personal uses such as home renovations, family weddings, travel, and emergency needs. A Personal Loan from ICICI Bank also helps create and boost a CIBIL Score within a limited period.

The ICICI Bank Personal Loan privileges are available for bank account holders and external customers therefore, why wait? Relieve your financial stress with an Instant ICICI Bank Personal Loan.

A Personal Loan is unsecured credit issued by Banks and NBFCS to fulfil lifestyle and emergency needs. It has become a widespread credit usage for individual needs, as obtaining a Personal Loan is fast, hassle-free, and with minimum documentation requirements.

Most lenders provide Personal Loans to salaried individuals as unsecured credit for short-term funding and seek prompt rotation of funds. Because Personal Loans are unsecured and granted without collateral, lenders have established a lending policy to ensure that the loan amount is repaid with interest within the specified time frame. Consequently, banks increasingly rely on CIBIL (Credit Bureau of India Ltd) information to assess loan seekers’ creditworthiness.

The CIBIL (Credit Bureau of India Ltd) began operations in 2007 as an agency for recording the credit usage data of individuals and organisations. Lenders regularly share data about the credit extended, which is then tabulated, and a credit history is maintained. This data is provided to the lender upon request. Before the CIBIL’s establishment, banks relied on their data to verify whether an applicant for a Personal Loan was a defaulter. Now, with a single point of record maintenance, lenders can share their customer experiences.

CIBIL initiated the system of generating a score in 2011, giving Lenders a consolidated numeric value for the creditworthiness of Loan seekers. To keep their default percentage minimum, most banks only process Personal Loans for applicants if their CIBIL score exceeds the required benchmark.

The exception is a few Lenders, of which HDFC Bank is the leading lender that considers Personal Loan Applications of lenders without a CIBIL Score.

Over the years, HDFC Bank has developed a robust Personal Loan portfolio. It has segmented its customer data to prioritise customers who have consistently repaid credit. If an applicant lacks a CIBIL Score, HDFC Bank will assess the Personal Loan request based on the merits of the following policy requirements.

When receiving a Personal Loan request, the HDFC Bank sends an enquiry to CIBIL to check the applicant’s credit history and CIBIL Score. In case the applicant is a first-time loan seeker or has recently acquired credit, the CIBIL will report the same as follows:

How will HDFC Bank evaluate the request and issue a Personal Loan to an applicant without a CIBIL Score? To obtain a Personal Loan from HDFC Bank without a CIBIL Score, the applicant’s profile must meet the following criteria.

Employment with a Company Included in the HDFC Bank Company Category List: HDFC Bank Processes Personal Loans for applicants whose employers are on the approved list. Applications are viewed favourably for individuals employed in Elite/Super A/Cat A and B Companies who are first-time credit seekers. Employees of these elite companies have stable employment with timely remuneration payments. Loan amounts are issued based on the applicant’s requirements.

Applicants without a CIBIL Score employed in categories C and D of the HDFC Bank Company Category List do not receive the same privileges as those in the upper categories. The approved loan amount and repayment term are limited.

Age Criteria: With age comes experience and stability it is expected that individuals will like to establish themselves with age and will avail suitable credit. If an applicant is over the age of 35 years and has been employed for several years, it is expected that they will use credit at some point, in the form of a Credit Card, auto loan or consumer loan. It will be only in unusual circumstances that there has been no credit usage.

Therefore, if an applicant is over 32 years old and has no Credit Score, HDFC Bank will view a Personal Loan request negatively. However, exceptions are made if the applicant is employed in government services or unusual situations.

Educational and Professional Qualifications: Higher education with a professional degree ensures a well-paying job and a secure future. Prominent companies listed in the HDFC Bank Company Category employ graduates from reputable institutes and offer enhanced packages. HDFC Bank provides the privileges of a Personal Loan to such applicants, even though they have yet to initiate a credit account and do not have a CIBIL history.

Monthly Income: Salaried individuals manage their budgets based on their monthly income. HDFC Bank Offers Personal Loans to salaried individuals earning 30k and above, employed by a company featured in the HDFC Bank Company Category List, without a Credit Score.

High-income applicants with a top-listed company are issued enhanced loan amounts, whereas applicants employed with lower-tier companies are issued restricted loan amounts.

The HDFC Bank entertains Personal Loan requests from applicants without a CIBIL Score who adhere to the other policy requirements. Having been trusted by the Bank and issued a Personal Loan, the onus lies with the customer to ensure timely repayments and complete the repayment over the allotted tenure to create a healthy CIBIL Score!

The CIBIL Score and credit history have become significant due to the increased use of credit for secured and unsecured loans. Lenders rely on individuals’ credit usage records to maintain their margins and refer to the data compiled by agencies. Before issuing credit, customer data is verified with CIBIL (Credit Bureau of India Ltd) to confirm an individual’s credit management skills. If an individual’s Credit Score meets the bank’s eligibility criteria, the request is processed otherwise, it is denied.

Maintaining score records in our country is not easy with our mammoth population. Customer details are manually entered and forwarded to CIBIL bi-monthly per the Reserve Bank of India norms. There is room for error that can lead to customer details being wrongly updated, which can further lead to credit being denied based on a record of unpaid dues or delayed payments.

At Yourloanadvisors.com, we have assisted customers who were denied credit. Below is one example of a customer who was denied credit due to her CIBIL being wrongly updated, and how we assisted her in rectifying the situation.

The Customer’s Predicament was as Follows: Reena Applied for a Credit Card with ICICI Bank. Although her request was declined, it did not upset her or raise any alarms, as it was not a pressing need. The next time she needed credit and Applied for a Personal Loan to renovate her home, her application was denied. The reason given was that her CIBIL Score was 640 points, which is significantly lower than the required benchmark of 730. The rejection was concerning since Reena could not understand why her CIBIL Score had declined.

The Profile Details: She is a salaried employee of a limited company (listed as Cat B in the Company Category List of HDFC Bank), earning an income of ₹ 55k per month. Reena was married and lived in a family-owned residence.

Reena contacted us after applying to other lenders, such as YES Bank, and facing rejections. By now, she was in despair and urgently seeking a solution to her problem.

Retrieving her CIBIL Report: The first step was to ask her to retrieve her CIBIL report directly by applying for it on the CIBIL Transunion website. Most lenders accept this authentic credit record when issuing a personal loan. Each time a bank sends an inquiry to CIBIL to retrieve an individual’s score and credit history, the score decreases by 10 to 15 points. Unaware of this fact, Reena unknowingly damaged her CIBIL Score further by applying to various banks.

As she had never Applied for a Personal Loan, she realised that an error had damaged her CIBIL Score. An NBFC issued a Personal Loan for a tenure of 12 months, which was included in her account. The last instalment for the loan was pending, with an outstanding interest amount.

Raising a Dispute with CIBIL: If there is an error, individuals can contact CIBIL to raise a dispute at and fill out an online dispute form. CIBIL will assist the customer to follow up with the lender to solve the issue.

Contacting the Lender Who Had Reported the Personal Loan Dues: We advised her to make an official complaint to the NBFC, citing her details and the disputed Loan entry in the CIBIL report and asking for further information on the loan’s registration.

To her surprise, she was listed as the loan holder. Her name and personal details, such as her address, matched the NBFC data, but her mobile number was missing. When she called the mobile number, she reached someone in another location who said the number belonged to her deceased brother. With a registered complaint in hand, she approached the NBFC again to verify the loan taker, who, after further investigation, admitted to the error in the report that was sent to CIBIL.

Coordinating with CIBIL for Rectification: Reena then obtained a certificate from the NBFC stating that she was exempt from any financial obligation and that no amount was due to the NBFC on her behalf. This certificate was forwarded to CIBIL, which acknowledged it and disputed the status of the Personal Loan. Finally, there seemed to be an end in sight as the NBFC agreed that the loan had not been awarded to her.

Updating the CIBIL Record: Reena felt eligible to apply for her personal loan with all the relevant proof. However, this was not the end her CIBIL Score had increased slightly but remained below the required benchmark. The CIBIL Score would only be corrected when the NBFC sent the amended report to CIBIL, after which the Disputed Personal Loan account would be removed from her history.

Improving the CIBIL Score: Reena was advised not to apply for further credit until the disputed loan account was erased from her CIBIL history, which could take another fortnight when the NBFC updated the status with CIBIL. As soon as the disputed account was removed from her CIBIL history, her score increased, and she fulfilled her loan requirement with a Personal Loan from HDFC Bank.

Sujata, an employee of a company featured in the Economic Times list of top companies, was surprised to receive offers for a Credit Card and Personal Loan just three months after she started working there. The offers came from ICICI Bank, with which she had her corporate salary account, and other prominent banks, such as HDFC Bank and AXIS Bank, and she was spoilt for choice.

For employees at companies classified as Category A or B in the HDFC Bank Company Category List, such as Sujata’s, these privileges are not just surprising, but also a testament to the benefits of working for a listed company. In contrast, applicants from Category C or D companies are not offered similar privileges, highlighting the advantages of being associated with a top-tier company.

Let us look into why Banks are ready to offer Personal Loans and Credit Cards to the employees of companies included in the approved list for sourcing.

Data analysis has shown that applicants working for listed companies are less likely to delay or default on their payments, making them the preferred segment for lending, particularly for unsecured Personal Loans and Credit Cards.

Income: Banks and NBFCS issue credit based on monthly income and the customer’s profile. Banks have an individual policy of a minimum salary requirement for issuing credit for lifestyle needs, such as Credit Cards and Personal Loans. Listed Company employees are favoured and entertained with a lower salary transfer. Some Banks restrict sourcing and require a higher income for Non-Listed Company Applicants.

Tenure: A Personal Loan’s tenure or repayment term is between 12 and 72 months. The bank sets the repayment term at the time of loan disbursal, and it remains fixed. Applicants from listed companies are granted a longer repayment tenure of 72 or even 84 months. In contrast, the term for applicants working in Category C or D companies is limited to 48 or 60 months.

Loan Amount and Credit Card Limit: Banks provide Personal Loans ranging from ₹ 1 Lakh to 40 Lakh, depending on the customer’s needs, monthly income, and repayment capacity. According to the bank’s eligibility criteria, the loan amount issued to applicants employed with listed companies is the maximum, as there is a cap on the loan amount for applicants employed with non-listed companies.

Similarly, for Credit Cards, the credit limit issued for an applicant working in an Economic Times-listed company will be higher than that of a private limited company not featured on the list.

Experience: Most banks require a minimum of one year of work experience to process a Personal Loan or a Credit Card. However, an exception is made for applicants working in the Approved Company Category List of Banks individuals employed with elite or super prime companies earning a monthly salary of ₹50,000 and above can apply with a continuity of three months or more.

However, customers employed by Non-Listed Companies are eligible for unsecured credit, although eligibility standards and lenders’ options are limited. If you work for a company not on the approved list of major banks, securing a personal loan or credit from banks that provide credit to non-listed companies, such as YES Bank and IndusInd Bank, is possible. There are key factors to keep in mind that will help secure credit.

Income: Banks ask for higher salary credits from non-listed company applicants. High-income applicants with a monthly salary of ₹ 1 Lakh and above are treated in a preferred category and are issued Credit Cards and Personal Loans despite working for an unlisted firm.

Stability: Applicants who own or have a family-owned residence and work with a government organisation are considered stable and financially eligible for unsecured credit if the lender’s other Eligibility Criteria are fulfilled.

The CIBIL Score requirement of 730 to 750 has become mandatory for a Credit Card or a Personal Loan. Applicants with a high CIBIL Score and a sound repayment track of existing credit are liable to be given credit readily when needed.

Having a successful financial relationship with a Bank and maintaining an account with a healthy balance at all times can significantly boost a credit application. This empowers the audience to take control of their financial health and be favorably viewed by lenders.

Company Turnover: The performance of the company the applicant is applying to is reviewed if the company is not listed in the AXIS Bank Company Category List, but the applicant has an account, and privileges of a Credit Card or a Personal Loan are awarded.

In conclusion, banks look for borrowers confident they will return the funds on time. As unsecured funds come without security, borrowers with secure backgrounds are preferred.

Companies in the approved list of banks are added after their profit margins and turnovers are constantly checked and verified. Organisations predicted to face a downturn, such as the travel industry, are delisted during COVID-19.

As the turnaround for Personal Loans is shorter and debt recovery is a mammoth task, Banks are reassured to extend credit to salaried employees of thriving companies. These employees are assured of receiving their salaries and can, in turn, pay their dues on time.

Banks are now a part of our everyday existence. They are the safekeepers of our earnings, offering various financial services, investments, and safe deposit boxes for jewellery and other precious items. There is an ongoing relationship with the bank that holds your funds. Whether it is a savings account, a salary account, or a business account, the services provided are according to the type of account and the balance maintained.

Lending is an integral part of the Banking business today. It involves issuing credit according to various customer needs, such as buying a new home, expanding a business, purchasing a new vehicle, or meeting individual and emergency needs.

Holding an account with a registered Bank has become necessary, whether with a private or government-aided Bank. However, it is not essential to maintain an account with the Bank to apply for credit. You can apply to any Bank that will suitably fulfil your funding requirements. However, a bank statement is a mandatory document required for issuing further credit, such as a secured loan, home loan, or mortgage, and for unsecured credit, like a Personal Loan or Credit Card. Personal Loans and Credit Cards are issued without security or guarantee, making an individual’s bank statement paramount.

The type of Bank account and the transactions reflect an individual’s financial standing based on income earned, spending patterns, and savings or balances maintained, which is crucial for assessing an individual’s economic worth and management abilities. An individual’s banking allows a lender to verify the income and current credit instalments being paid.

Are you Applying for an HDFC Bank Personal Loan or an ICICI Bank Coral Credit Card? A three-month bank statement must be submitted as part of the documentation required to process your Personal Loan and Credit Card requests from a bank or NBFC. Note the following before submitting your bank statement.

Your bank account serves more than merely the purpose of depositing and withdrawing money. By holding deposits with ICICI Bank, you can access the Emeralde Credit Card or Rubyx Credit Card privileges.

With the onset of digital Banking, accessing your Bank statement is convenient. You can download it from your computer or even your mobile phone. When downloading your bank statement, note the following steps to expedite processing your loan request.

Further, the lender will verify the statement submitted for discrepancies before processing the loan request.

Your bank account reflects your financial standing. Prioritise tracking your transactions and budgeting your expenses. A healthy bank account with sufficient funds to cover the costs can greatly facilitate obtaining credit when necessary for building assets, meeting lifestyle needs, and having resources in emergencies.