A Personal Loan is commonly used to fulfil lifestyle needs most salaried individuals prefer to apply for one as it is processed quickly and conveniently. Banks and NBFCS provide unsecured Personal Loans to borrowers to meet individual requirements, with terms and conditions applicable to the specific policy. Over the years, ICICI Bank has emerged as the preferred personal loan lender, offering a streamlined online process that ensures a hassle-free experience. Need a Personal Loan? Let us explore why ICICI Bank is the primary choice for Applying for a Personal Loan.

An individual’s CIBIL Score has become a vital mandate for securing credit, a Personal Loan, and a Credit Card. Banks are apprehensive about issuing unsecured credit to applicants who have not used credit and do not have a CIBIL Score. The ICICI Bank, with its robust lending track, also forwards loans to applicants who are first-time loan seekers and do not have a CIBIL Score and history. If you have a CIBIL record, you must have a CIBIL Score of 750 and above to secure a Personal Loan or Credit Card.

If you want to increase your loan amount for personal needs, Apply to ICICI Bank. ICICI Bank offers enhanced loan amounts to Prime applicants earning a salary of ₹ 1 lakh and above. The maximum loan amount of ₹ 50 lakhs is available as an unsecured loan to customers under the most favourable terms. The calculations for loan amounts are more comprehensive than those of other banks. For example, ICICI Bank considers the total net salary transferred to the bank account each month, which includes narrations such as the monthly bonus, which other Banks do not include in the calculation for eligibility for the loan amount.

Receive your Personal Loan funds within 48 hours with prioritised processing from ICICI Bank. ICICI Bank is the premier institution to have initiated a completely online application and processing system for Personal Loans. Now, applicants can apply and receive funds in the comfort of their home or office by filling out the application form online and providing soft copies of readily available documentation.

The Bank will conduct a document and CIBIL check digitally. KYC (Know Your Customer) is completed via a video call. The applicant must present the original KYC Documents, such as Aadhaar Cards and PAN Cards, and verify their signature. With all customer information accessible online, the ICICI Bank credit team approves the request within 48 hours.

The ICICI Bank Personal Loan policy encompasses customers from all segments meeting the Personal Loan Eligibility Criteria.

ICICI Bank has an extensive list of premier companies categorised as Elite, Prime, Super Prime, and Preferred. Most banks provide personal loans to employees of these organisations. Suppose you are employed by a company that does not appear on the approved list. In that case, ICICI Bank is the foremost financier offering Personal Loans to Non-Listed Company Employees. The loan amount issued is according to the customer’s net salary and obligations, without restrictions on employment in a non-listed company.

When you Apply for a Personal Loan at ICICI Bank, you can expect the lowest interest rate, starting from 10.99%. The processing fees are a one-time charge deducted from the loan amount on disbursal of funds. An agreement is sent for the customer to acknowledge, with the terms of the loan including;

The Personal Loan agreement clearly outlines all applicable charges, with no hidden fees. ICICI Bank offers 24/7 assistance through the toll-free customer care number 1800-1080. Customers can also address their queries to customercare@icicibank.com.

ICICI Bank issues a personal loan in various formats tailored to the customer’s requirements:

Personal loan Top Up: ICICI Bank values the relationship with existing personal loan customers. If surplus funds are required, the amount needed is issued as a top-up to the existing personal loan. With a Top-up Personal Loan, the applicant is offered the best-in-class interest and is comfortable paying a single EMI for the total loan amount.

Personal Loan Balance Transfer: ICICI Bank offers to take over a customer’s personal loan from another lender, paying a higher interest rate. Customers with a CIBIL Score of 750 points who pay the EMI on time receive a lower interest rate and discounted processing fees. With a Balance Transfer, the applicant can apply for an extra loan amount and restructure the loan for a longer repayment tenure.

Parallel Loan: Are you currently using a Personal Loan from ICICI Bank? ICICI Bank offers additional personal loans as a parallel loan to customers who successfully manage their existing personal loans and seek extra funds. The Parallel Loan functions independently of the existing loan, and the additional loan is granted if the applicant has the financial capacity to pay an extra EMI and meets the bank’s eligibility criteria.

In summary, ICICI Bank Personal Loans suitably assist customers with funds for personal uses such as home renovations, family weddings, travel, and emergency needs. A Personal Loan from ICICI Bank also helps create and boost a CIBIL Score within a limited period.

The ICICI Bank Personal Loan privileges are available for bank account holders and external customers therefore, why wait? Relieve your financial stress with an Instant ICICI Bank Personal Loan.

A Personal Loan is unsecured credit issued by Banks and NBFCS to fulfil lifestyle and emergency needs. It has become a widespread credit usage for individual needs, as obtaining a Personal Loan is fast, hassle-free, and with minimum documentation requirements.

Most lenders provide Personal Loans to salaried individuals as unsecured credit for short-term funding and seek prompt rotation of funds. Because Personal Loans are unsecured and granted without collateral, lenders have established a lending policy to ensure that the loan amount is repaid with interest within the specified time frame. Consequently, banks increasingly rely on CIBIL (Credit Bureau of India Ltd) information to assess loan seekers’ creditworthiness.

The CIBIL (Credit Bureau of India Ltd) began operations in 2007 as an agency for recording the credit usage data of individuals and organisations. Lenders regularly share data about the credit extended, which is then tabulated, and a credit history is maintained. This data is provided to the lender upon request. Before the CIBIL’s establishment, banks relied on their data to verify whether an applicant for a Personal Loan was a defaulter. Now, with a single point of record maintenance, lenders can share their customer experiences.

CIBIL initiated the system of generating a score in 2011, giving Lenders a consolidated numeric value for the creditworthiness of Loan seekers. To keep their default percentage minimum, most banks only process Personal Loans for applicants if their CIBIL score exceeds the required benchmark.

The exception is a few Lenders, of which HDFC Bank is the leading lender that considers Personal Loan Applications of lenders without a CIBIL Score.

Over the years, HDFC Bank has developed a robust Personal Loan portfolio. It has segmented its customer data to prioritise customers who have consistently repaid credit. If an applicant lacks a CIBIL Score, HDFC Bank will assess the Personal Loan request based on the merits of the following policy requirements.

When receiving a Personal Loan request, the HDFC Bank sends an enquiry to CIBIL to check the applicant’s credit history and CIBIL Score. In case the applicant is a first-time loan seeker or has recently acquired credit, the CIBIL will report the same as follows:

How will HDFC Bank evaluate the request and issue a Personal Loan to an applicant without a CIBIL Score? To obtain a Personal Loan from HDFC Bank without a CIBIL Score, the applicant’s profile must meet the following criteria.

Employment with a Company Included in the HDFC Bank Company Category List: HDFC Bank Processes Personal Loans for applicants whose employers are on the approved list. Applications are viewed favourably for individuals employed in Elite/Super A/Cat A and B Companies who are first-time credit seekers. Employees of these elite companies have stable employment with timely remuneration payments. Loan amounts are issued based on the applicant’s requirements.

Applicants without a CIBIL Score employed in categories C and D of the HDFC Bank Company Category List do not receive the same privileges as those in the upper categories. The approved loan amount and repayment term are limited.

Age Criteria: With age comes experience and stability it is expected that individuals will like to establish themselves with age and will avail suitable credit. If an applicant is over the age of 35 years and has been employed for several years, it is expected that they will use credit at some point, in the form of a Credit Card, auto loan or consumer loan. It will be only in unusual circumstances that there has been no credit usage.

Therefore, if an applicant is over 32 years old and has no Credit Score, HDFC Bank will view a Personal Loan request negatively. However, exceptions are made if the applicant is employed in government services or unusual situations.

Educational and Professional Qualifications: Higher education with a professional degree ensures a well-paying job and a secure future. Prominent companies listed in the HDFC Bank Company Category employ graduates from reputable institutes and offer enhanced packages. HDFC Bank provides the privileges of a Personal Loan to such applicants, even though they have yet to initiate a credit account and do not have a CIBIL history.

Monthly Income: Salaried individuals manage their budgets based on their monthly income. HDFC Bank Offers Personal Loans to salaried individuals earning 30k and above, employed by a company featured in the HDFC Bank Company Category List, without a Credit Score.

High-income applicants with a top-listed company are issued enhanced loan amounts, whereas applicants employed with lower-tier companies are issued restricted loan amounts.

The HDFC Bank entertains Personal Loan requests from applicants without a CIBIL Score who adhere to the other policy requirements. Having been trusted by the Bank and issued a Personal Loan, the onus lies with the customer to ensure timely repayments and complete the repayment over the allotted tenure to create a healthy CIBIL Score!

The CIBIL Score and credit history have become significant due to the increased use of credit for secured and unsecured loans. Lenders rely on individuals’ credit usage records to maintain their margins and refer to the data compiled by agencies. Before issuing credit, customer data is verified with CIBIL (Credit Bureau of India Ltd) to confirm an individual’s credit management skills. If an individual’s Credit Score meets the bank’s eligibility criteria, the request is processed otherwise, it is denied.

Maintaining score records in our country is not easy with our mammoth population. Customer details are manually entered and forwarded to CIBIL bi-monthly per the Reserve Bank of India norms. There is room for error that can lead to customer details being wrongly updated, which can further lead to credit being denied based on a record of unpaid dues or delayed payments.

At Yourloanadvisors.com, we have assisted customers who were denied credit. Below is one example of a customer who was denied credit due to her CIBIL being wrongly updated, and how we assisted her in rectifying the situation.

The Customer’s Predicament was as Follows: Reena Applied for a Credit Card with ICICI Bank. Although her request was declined, it did not upset her or raise any alarms, as it was not a pressing need. The next time she needed credit and Applied for a Personal Loan to renovate her home, her application was denied. The reason given was that her CIBIL Score was 640 points, which is significantly lower than the required benchmark of 730. The rejection was concerning since Reena could not understand why her CIBIL Score had declined.

The Profile Details: She is a salaried employee of a limited company (listed as Cat B in the Company Category List of HDFC Bank), earning an income of ₹ 55k per month. Reena was married and lived in a family-owned residence.

Reena contacted us after applying to other lenders, such as YES Bank, and facing rejections. By now, she was in despair and urgently seeking a solution to her problem.

Retrieving her CIBIL Report: The first step was to ask her to retrieve her CIBIL report directly by applying for it on the CIBIL Transunion website. Most lenders accept this authentic credit record when issuing a personal loan. Each time a bank sends an inquiry to CIBIL to retrieve an individual’s score and credit history, the score decreases by 10 to 15 points. Unaware of this fact, Reena unknowingly damaged her CIBIL Score further by applying to various banks.

As she had never Applied for a Personal Loan, she realised that an error had damaged her CIBIL Score. An NBFC issued a Personal Loan for a tenure of 12 months, which was included in her account. The last instalment for the loan was pending, with an outstanding interest amount.

Raising a Dispute with CIBIL: If there is an error, individuals can contact CIBIL to raise a dispute at and fill out an online dispute form. CIBIL will assist the customer to follow up with the lender to solve the issue.

Contacting the Lender Who Had Reported the Personal Loan Dues: We advised her to make an official complaint to the NBFC, citing her details and the disputed Loan entry in the CIBIL report and asking for further information on the loan’s registration.

To her surprise, she was listed as the loan holder. Her name and personal details, such as her address, matched the NBFC data, but her mobile number was missing. When she called the mobile number, she reached someone in another location who said the number belonged to her deceased brother. With a registered complaint in hand, she approached the NBFC again to verify the loan taker, who, after further investigation, admitted to the error in the report that was sent to CIBIL.

Coordinating with CIBIL for Rectification: Reena then obtained a certificate from the NBFC stating that she was exempt from any financial obligation and that no amount was due to the NBFC on her behalf. This certificate was forwarded to CIBIL, which acknowledged it and disputed the status of the Personal Loan. Finally, there seemed to be an end in sight as the NBFC agreed that the loan had not been awarded to her.

Updating the CIBIL Record: Reena felt eligible to apply for her personal loan with all the relevant proof. However, this was not the end her CIBIL Score had increased slightly but remained below the required benchmark. The CIBIL Score would only be corrected when the NBFC sent the amended report to CIBIL, after which the Disputed Personal Loan account would be removed from her history.

Improving the CIBIL Score: Reena was advised not to apply for further credit until the disputed loan account was erased from her CIBIL history, which could take another fortnight when the NBFC updated the status with CIBIL. As soon as the disputed account was removed from her CIBIL history, her score increased, and she fulfilled her loan requirement with a Personal Loan from HDFC Bank.

Sujata, an employee of a company featured in the Economic Times list of top companies, was surprised to receive offers for a Credit Card and Personal Loan just three months after she started working there. The offers came from ICICI Bank, with which she had her corporate salary account, and other prominent banks, such as HDFC Bank and AXIS Bank, and she was spoilt for choice.

For employees at companies classified as Category A or B in the HDFC Bank Company Category List, such as Sujata’s, these privileges are not just surprising, but also a testament to the benefits of working for a listed company. In contrast, applicants from Category C or D companies are not offered similar privileges, highlighting the advantages of being associated with a top-tier company.

Let us look into why Banks are ready to offer Personal Loans and Credit Cards to the employees of companies included in the approved list for sourcing.

Data analysis has shown that applicants working for listed companies are less likely to delay or default on their payments, making them the preferred segment for lending, particularly for unsecured Personal Loans and Credit Cards.

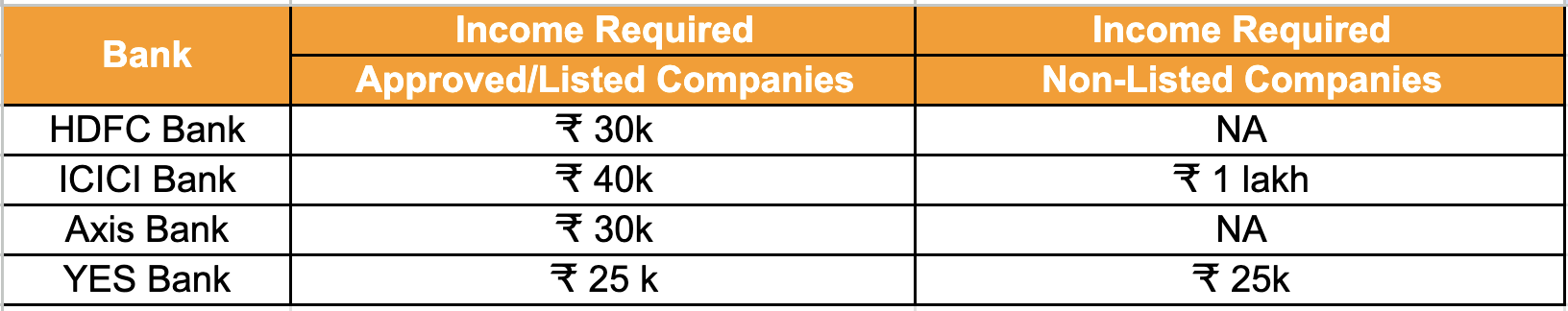

Income: Banks and NBFCS issue credit based on monthly income and the customer’s profile. Banks have an individual policy of a minimum salary requirement for issuing credit for lifestyle needs, such as Credit Cards and Personal Loans. Listed Company employees are favoured and entertained with a lower salary transfer. Some Banks restrict sourcing and require a higher income for Non-Listed Company Applicants.

Tenure: A Personal Loan’s tenure or repayment term is between 12 and 72 months. The bank sets the repayment term at the time of loan disbursal, and it remains fixed. Applicants from listed companies are granted a longer repayment tenure of 72 or even 84 months. In contrast, the term for applicants working in Category C or D companies is limited to 48 or 60 months.

Loan Amount and Credit Card Limit: Banks provide Personal Loans ranging from ₹ 1 Lakh to 40 Lakh, depending on the customer’s needs, monthly income, and repayment capacity. According to the bank’s eligibility criteria, the loan amount issued to applicants employed with listed companies is the maximum, as there is a cap on the loan amount for applicants employed with non-listed companies.

Similarly, for Credit Cards, the credit limit issued for an applicant working in an Economic Times-listed company will be higher than that of a private limited company not featured on the list.

Experience: Most banks require a minimum of one year of work experience to process a Personal Loan or a Credit Card. However, an exception is made for applicants working in the Approved Company Category List of Banks individuals employed with elite or super prime companies earning a monthly salary of ₹50,000 and above can apply with a continuity of three months or more.

However, customers employed by Non-Listed Companies are eligible for unsecured credit, although eligibility standards and lenders’ options are limited. If you work for a company not on the approved list of major banks, securing a personal loan or credit from banks that provide credit to non-listed companies, such as YES Bank and IndusInd Bank, is possible. There are key factors to keep in mind that will help secure credit.

Income: Banks ask for higher salary credits from non-listed company applicants. High-income applicants with a monthly salary of ₹ 1 Lakh and above are treated in a preferred category and are issued Credit Cards and Personal Loans despite working for an unlisted firm.

Stability: Applicants who own or have a family-owned residence and work with a government organisation are considered stable and financially eligible for unsecured credit if the lender’s other Eligibility Criteria are fulfilled.

The CIBIL Score requirement of 730 to 750 has become mandatory for a Credit Card or a Personal Loan. Applicants with a high CIBIL Score and a sound repayment track of existing credit are liable to be given credit readily when needed.

Having a successful financial relationship with a Bank and maintaining an account with a healthy balance at all times can significantly boost a credit application. This empowers the audience to take control of their financial health and be favorably viewed by lenders.

Company Turnover: The performance of the company the applicant is applying to is reviewed if the company is not listed in the AXIS Bank Company Category List, but the applicant has an account, and privileges of a Credit Card or a Personal Loan are awarded.

In conclusion, banks look for borrowers confident they will return the funds on time. As unsecured funds come without security, borrowers with secure backgrounds are preferred.

Companies in the approved list of banks are added after their profit margins and turnovers are constantly checked and verified. Organisations predicted to face a downturn, such as the travel industry, are delisted during COVID-19.

As the turnaround for Personal Loans is shorter and debt recovery is a mammoth task, Banks are reassured to extend credit to salaried employees of thriving companies. These employees are assured of receiving their salaries and can, in turn, pay their dues on time.

Banks are now a part of our everyday existence. They are the safekeepers of our earnings, offering various financial services, investments, and safe deposit boxes for jewellery and other precious items. There is an ongoing relationship with the bank that holds your funds. Whether it is a savings account, a salary account, or a business account, the services provided are according to the type of account and the balance maintained.

Lending is an integral part of the Banking business today. It involves issuing credit according to various customer needs, such as buying a new home, expanding a business, purchasing a new vehicle, or meeting individual and emergency needs.

Holding an account with a registered Bank has become necessary, whether with a private or government-aided Bank. However, it is not essential to maintain an account with the Bank to apply for credit. You can apply to any Bank that will suitably fulfil your funding requirements. However, a bank statement is a mandatory document required for issuing further credit, such as a secured loan, home loan, or mortgage, and for unsecured credit, like a Personal Loan or Credit Card. Personal Loans and Credit Cards are issued without security or guarantee, making an individual’s bank statement paramount.

The type of Bank account and the transactions reflect an individual’s financial standing based on income earned, spending patterns, and savings or balances maintained, which is crucial for assessing an individual’s economic worth and management abilities. An individual’s banking allows a lender to verify the income and current credit instalments being paid.

Are you Applying for an HDFC Bank Personal Loan or an ICICI Bank Coral Credit Card? A three-month bank statement must be submitted as part of the documentation required to process your Personal Loan and Credit Card requests from a bank or NBFC. Note the following before submitting your bank statement.

Your bank account serves more than merely the purpose of depositing and withdrawing money. By holding deposits with ICICI Bank, you can access the Emeralde Credit Card or Rubyx Credit Card privileges.

With the onset of digital Banking, accessing your Bank statement is convenient. You can download it from your computer or even your mobile phone. When downloading your bank statement, note the following steps to expedite processing your loan request.

Further, the lender will verify the statement submitted for discrepancies before processing the loan request.

Your bank account reflects your financial standing. Prioritise tracking your transactions and budgeting your expenses. A healthy bank account with sufficient funds to cover the costs can greatly facilitate obtaining credit when necessary for building assets, meeting lifestyle needs, and having resources in emergencies.

Borrowing finance comes at a cost. Banks provide finance in various forms, including loans tailored to specific end uses and requirements, such as Home Loans, Loans Against Property, Vehicle Loans, Business Loans for funding growth, and Personal Loans for individual needs.

Premier lenders offer Personal Loans without collateral for repayment within a short term. Banks and NBFCs provide quick finance through Personal Loans to applicants for various purposes, including home renovation, wedding expenses, family holidays, and emergency needs.

The significant charges for a Personal Loan include the Interest payable on the loan amount. Let us examine the terms under which interest is charged and the factors that affect the interest rate charged by Banks and NBFCS.

The current Interest Rate for a Personal Loan Ranges from 10.99% to 20%. The interest charged for a Personal Loan varies among lenders and is determined based on the cost of funds and each lender’s policies. The customer may be offered different Personal Loan Interest Rates from alternative banks. Let us examine the factors affecting the interest rates charged by banks and NBFCs

Cost of Funds: Banks and NBFCs charge Interest Rates for Personal Loans based on their cost of funds, the Reserve Bank of India issues funds to Banks when in need, against government securities which are repurchased by the Bank as per the Reserve Bank of India repurchase rate or Repo Rate as is commonly known as. A reduced Repo Rate enables Banks to lend at a lower interest rate, and vice versa. Although the fluctuations in the repo rate do not directly affect personal loan lending rates, Banks are asked to review rates and increase lending to infuse cash into the system. With the recent cut in the Repo Rate, home loan rates are being reviewed, although Personal Loan rates have not yet been changed.

The cost of funds also includes the bank’s turnover and profit margins from other services. If banks have increased profits and kept delinquencies under control, a lower interest rate is applied to performing segments.

Policy of the Lender: All lenders, including banks and Non-Banking Financial Companies (NBFCs), establish individual policies for retail lending in the Personal Loan segment. The terms and conditions, as well as the interest rate, are applied following the Bank’s policy. Banks offer discounts on interest rates to:

CIBIL Score, Existing Relationship and Special Offers: A good CIBIL Score of 750+ is the gateway to getting easy credit with the best terms. Individuals who use credit and make timely payments are offered the lowest interest rates for a Personal Loan Top-up on an existing loan or as a Personal loan Balance Transfer from an external Bank.

Customers holding accounts and maintaining a healthy Bank Balance, or those with an existing credit relationship, are encouraged, and further credit is extended to them at discounted rates.

While it is essential to know and verify the interest charged on your Personal Loan, noting the features will help you calculate the costs associated with the loan amount.

Interest is Charged at a Monthly Reducing Balance Rate. The interest for a Personal Loan is applied to the monthly reduced principal balance. The EMI (Equated Monthly Installment) charged for repayment of your Personal Loan consists of part principal and interest. Therefore, with every instalment repaid, your principal loan is reduced. The next instalment is charged on the reduced principal amount.

Interest is Applied Annually: The tenure for a Personal Loan is issued yearly therefore, the interest repaid annually is flat. For example;

The Interest Rate on a Personal Loan Remains Fixed for the Entire Duration. It is fixed upon approval of the loan amount and the tenure for which the loan is granted. The EMI for the loan amount is deducted through ECS from the salary account as per the mandate signed by the customer. Unlike the interest on a home loan, which is applied at a floating rate and fluctuates with the change in the REPO Rate, the Personal Loan Interest Rate remains unchanged.

Finally, the applicable interest charged is revealed only after the loan is approved. The lender’s credit officer considers the details of the customer listed above to determine the interest to be charged.

A Personal Loan Top-up is a convenient and quick way to access funds, making it an excellent option for you. But can you assume that the parent bank will meet your needs as desired? To assist you in making a decision, please review the points below.

Interval Between Applying:- There should be an appropriate gap since the disbursement of the primary loan. If you have recently taken out a Personal Loan, banks issuing Personal Loan Top-ups, such as HDFC Bank and ICICI Bank, prefer a gap of three months or more before issuing funds as a top-up to your Existing Personal Loan. This gap ensures that you make timely repayments, a condition particularly applicable to first-time borrowers.

Your CIBIL Score is a crucial factor in determining your Eligibility for a Personal Loan Top-up It must meet the required benchmark. The CIBIL Score and repayment history are verified before issuing further funds as a top loan. The track record of repayment for existing bank loans that require a top-up, as well as other loans from external lenders, should be smooth. Dues on the Credit Card being used must also be cleared.

Company Category and Employment Profile:- The procedure for Applying for a Top-up Loan is the same as for a New Personal Loan. Therefore, all the applicant’s parameters are checked. If the applicant has changed employment, the current employer should be listed in HDFC Bank’s Company Category List. If the company is not featured in the approved company category list, the applicant can apply with an alternate bank for a Parallel Loan.

Financial Eligibility:- The loan amount issued as a Top-up is based on the bank’s eligibility criteria and the applicant’s capacity to afford the extra EMI. If the applicant has taken on other credit recently in the form of a mortgage loan or Auto loan, all the current EMI will be taken into account when calculating the eligibility for extra funds to be added to the existing personal loan as a Top Up. Use an EMI Calculator to calculate a suitable EMI before applying.

Prepayment Option:- If you are running a HDFC Bank Personal Loan or an ICICI Bank Personal Loan, you have the option to foreclose your loan after paying 12 instalments by settling the principal amount balance, for which a fee is applicable depending on the loan amount borrowed. If you wish to repay the loan amount promptly, Applying for a Parallel Loan, which is a separate loan taken from another bank, is a better option, as both loans are independent and can be foreclosed after the Bank’s terms are fulfilled.

Interest Rate:- Before Applying for a Personal Loan Top-up, it’s essential to compare the interest rates offered by other lenders. If you have a good CIBIL Score and an on-time repayment record, other Banks can provide you with a lower interest rate and additional funds through a Balance Transfer of a Personal Loan. This comparison can empower you to make the best financial decision for your situation.

A Personal Loan for salaried individuals has become popular as Banks offer loan amounts tailored to individual needs without requiring any collateral. If you have steady employment and are managing your finances well, Banks are willing to provide Personal Loans. Furthermore, if you fulfil all your financial commitments, a Top-up to your Existing Personal Loan is readily available.

Banks offer quick and convenient funds as Personal Loans for all individual needs or shortages. It is essential to note that the charges for a Personal Loan vary from lender to lender and also depend on the applicant’s profile. Getting funds at the lowest costs is a priority, so how can you calculate the rate at which you will be given funds and the key points that will determine the cost of your loan? Taking note of the following will help you secure the best deal for your Personal Loan Requirements.

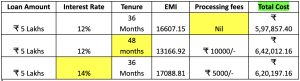

When Applying for a Personal Loan, it’s essential to prioritise your needs. This will help you determine which charges will have the most significant impact on the total cost. Here are some basic costs that can help you understand the difference.

The Interest Rate is the primary cost of funds. The Current Personal Loan Rate Ranges from 10.99% to 16% Annually.

Your Net Salary: Banks issue a lower interest rate to high-income applicants. Most lenders classify interest rates according to income therefore, an individual with a net income of ₹ 35k applying for an HDFC Bank Personal Loan can expect a higher interest rate than an applicant with a monthly salary of ₹ 50k.

The Loan Amount You are Eligible for: The sanctioned loan amount for an applicant significantly impacts the Personal Loan Interest Rate. Customers with an income of ₹75,000 and above are considered elite, eligible for a loan amount of ₹10 lakhs and above. They are offered the lowest available interest rate of 10.99%, while applicants seeking lesser amounts of ₹5 lakhs will incur an interest rate of 11.99%.

Your Company Category plays a significant role in the unsecured lending sector of Personal Loans. Being employed by a company listed in the Economic Times or an organisation categorised as Category A on the Approved HDFC Bank Company Category List for Personal Loans, or as an Elite company on the ICICI Bank Company Category List, can help you secure the best terms for your loan. This knowledge empowers you to be strategic and proactive in your loan application.

Important to Note: As the interest rate is a significant expense, the information above will assist you in finding the most suitable lender based on your income and loan requirements. For instance, if you are employed by a company listed in the HDFC Bank’s Company Category, the lowest interest rate for your personal loan is offered by HDFC Bank. However, if you work for a non-listed firm and your monthly salary exceeds ₹ 50,000, the lowest interest rate for your personal loan is provided by ICICI Bank.

Processing Fees: The processing fees are a one-time file charge levied by Banks this is the file charge or expenses incurred by the Bank for issuing the loan. The processing fees for a Personal Loan can be up to 2% of the amount disbursed. Still, discounts are offered to eligible customers working with companies that feature in the approved company category list of the Bank, specially targeted segments such as government employees and high-salaried customers applying for a personal loan of ₹10 lakhs and above.

Rather than charging a percentage of the loan, premier Banks such as HDFC Bank and ICICI Bank now charge a flat amount of ₹ 4000/—to ₹ 10000/-, depending on the loan amount appended to the customer. When you apply for a YES Bank Personal Loan, the processing fees are 1% to 1.5% of the loan amount forwarded to the customer.

What You Need to Evaluate: Applicants often consider the interest rate when Applying for a Personal Loan, but overlook the processing fees. It is important to note that the processing fees are an upfront charge deducted from the loan issued, which will affect the loan amount you expect to receive in your account. Ensure you incorporate the processing fees into the total loan amount you require. If a significant loan amount is necessary, the percentage charged as processing fees will increase the overall loan costs. Therefore, seek a bank to help minimise these costs and charge you a minimal processing fee.

The Monthly Installment Payable (EMI): A Personal Loan Repayment is made through the EMI, which is deducted on a fixed date from the salary account. The total cost of your loan will vary depending on the amount you can repay monthly as an EMI towards the amount borrowed as a Personal Loan. The interest charged for a Personal Loan is applied annually, so the shorter the repayment tenure or the quicker you can repay your loan, the less the cost.

Selecting a tenure option is not just about the cost of the Personal Loan. It’s also about ensuring that your monthly EMI is comfortably affordable. By reflecting on your monthly budget and any other credit EMIs that need to be paid, you can make a responsible decision that keeps you in control of your finances.

When allotting tenure, the bank will also consider your monthly income, other obligations, and the employer’s company category. An applicant can request a repayment tenure, but the final option rests with the Bank. The EMI Calculator can help you check for a suitable EMI for the loan amount required before applying for a loan. If you feel the EMI is too steep, you can apply for a lesser loan amount.

Other factors include prepayment penalties and repaying part of the loan. If the loan is needed for a limited period, you can compare the policies of various banks regarding the foreclosure clause. Look for a lender who will allow you to repay the loan amount with the least penalty. If your CIBIL Score is well above the required benchmark, Banks are confident in lending large amounts for a longer tenure with favourable terms. In contrast, aberrations in the score and history can make funds costlier.

Applicants can now quickly check for Personal Loan information online, as Banks and NBFCs update their websites with the Personal Loan Interest Rate and terms offered. Making an informed decision and checking out the complete cost before Applying for a Personal Loan will go a long way in lowering your Personal Loan Costs.

A Personal Loan is issued for lifestyle expenses and emergencies—banks and NBFCs market personal loans as a premium product for the salaried class. Salaried customers receive a monthly salary in the bank, offering transparency regarding their income and expenses. Lenders are comfortable providing short-term funds to customers based on their monthly income, which is repaid through Equated Monthly Instalments (EMI). A Personal Loan is primarily granted based on the monthly salary received by an applicant. Consequently, the Personal Loan Criteria, such as the loan amount and interest rate, are determined and applied according to the monthly wage. The salary bracket is broadly defined as follows: Salaries processed are segmented by banks as follows:

Eligibility criteria for a Salary of 25k to 30k: The minimum income benchmark set by Banks for a Personal Loan is a salary of ₹ 25k. This is the amount a graduate employee can expect at the start for basic expenses and spare funds to invest in a new mobile phone and home appliances with a personal loan. Banks that issue Personal loans to applicants with a salary of above ₹ 25k are YES Bank and IDFC Bank. NBFCs that offer Personal loans to applicants with a salary of ₹ 25k include Fullerton India, INCRED and Hero Finance. To Apply for a Personal Loan to YES Bank, an applicant must fulfil the other YES Bank Personal Loan Eligibility Criteria and have a CIBIL score of 700+.

Personal Loan Eligibility for applicants with a salary of ₹ 30k to ₹40k per month: With the rise in inflation and living costs and the corresponding increase in earnings, the previous benchmark of a salary of ₹ 20k is now increased to ₹30k to Apply for an HDFC Bank Personal Loan and an Axis Bank Personal Loan. An applicant working in a CAT A company featured in the HDFC Bank Company Category List is eligible for a loan amount of ₹ 500000 lakhs to be repaid with an EMI of 13167/- over a tenure of 48 months. HDFC Bank permits applicants with a salary of ₹ 30k and above without a CIBIL score and no previous credit history to Apply for a Personal Loan if the company features in the Approved Company Category List.

Personal Loan options for applicants with a salary of ₹ 40k and above: A monthly salary of ₹ 40k transferred to the Bank fulfils the eligibility for income criteria of most Banks. Applicants can apply for an ICICI Bank Personal Loan and an ICICI Bank Coral Credit Card with a salary of ₹ 40k and above. The income is sufficient to cover monthly expenses and apply for credit when required for a family wedding, home renovation, or education expenses. The maximum amount an applicant can get as a Personal Loan is ₹5lakhs to 8 lakhs depending on the CIBIL score and if the employer features in the approved company category list. It is not mandatory for the applicant to have a CIBIL Score to Apply for a Personal Loan from HDFC Bank.

Eligibility for High-income applicants with an income of ₹ 50k, ₹75k and above: With a higher income, the terms of Banks are revamped; the multiplier applied for the loan amount an applicant is eligible for increases as the income allows expenditure over and above the monthly budgets. Maximum loan amounts of ₹ 30 to 35 lakhs are issued to eligible customers with discounted interest rates and extended repayment terms. Customers earning over ₹ 75000/- are treated as Elite customers, and the personal loan application is processed under the Golden Edge Personal Loan category with favourable terms. A waiver of the penalty clause for foreclosure of a personal loan after paying 12 EMI is offered for loan amounts above ₹ 10 lakhs.

Further, to verify the salary received to process the loan requirements, the following terms must be qualified according to the personal loan eligibility criteria:

Personal Loan applicants can use an EMI Calculator to determine an affordable EMI based on their monthly earnings. Whether they’re an IT professional working for a company listed in the Economic Times or a government employee, their income and stability make them a preferred lending category. Personal Loans have become a convenient option, with loan amounts processed online, allowing salaried applicants to receive funds within 72 hours to address financial shortfalls!

The recent Repo Rate cut of 0.25 basis points has given borrowers a moment of cheer, but various factors determine how the rate cut will filter down and lower interest rates and monthly instalments. Expecting your current loan to cost less or thinking of taking fresh credit, let us explore the implications of the Repo Rate cut.

What does the rate cut mean for home loans and Mortgages, depending on the terms of your loan?

The customer can repay with a fixed or Floating Interest Rate when appending a Home Loan. Fluctuations in the Repo Rate (the RBI’s repurchase rate) will directly affect customers repaying their home loans at a Floating Interest Rate. Home buyers running a loan with a floating rate can expect a change in their interest rate according to the revision cycle of two to three months.

With a fixed interest rate applicable for a home loan, the interest rate does not change if the Repo Rate increases or decreases. The EMI remains constant for the duration of the fixed term. Banks usually offer a fixed interest rate for 2 to 3 years, after which the existing Floating Interest Rate is applied.

Thus, customers with a Floating Interest Rate can take advantage of the rate cut when the date for the revision as per the cycle is due, whereas applicants with a fixed interest rate will have to wait for the fixed term to end.

Is your Home Loan operating under the RLLR (repo rate linked), EBLR (External benchmark linked rate) or MCLR (marginal cost of funds) regime?

In 2019, the RBI initiated the Repo rate-linked mortgage system and advised banks to issue loans under the RLLR or repo rate-linked regime to pass on the benefits of a rate directly to customers.

Banks’ lending under the Repo rate-linked scheme will add a spread to the base rate for example, with a Repo Rate of 6.5%, a Bank adding 2.5% as operating costs and profit will issue a home loan at 9%. With the .25% reduction in the Repo Rate, customers with a Floating Interest Rate will be offered a reduced rate. Loan holders can opt for a reduced EMI or tenure to avail of the benefit.

The EBLR Rate issued by Banks is linked to the Repo Rate as the external benchmark a variation in the Repo Rate is carried forward to the EBLR Rate, though the Bank operating costs are included in the spread when issuing an EBLR Rate.

The interest rate issued by Banks under the MCLR scheme can vary from Lender to Lender. The key factors for calculating the MCLR Rate are the Repo Rate, the cost funds, the deposit rates, operating costs and profit margin. Thus, the Repo Rate reduction may not immediately reflect in the interest rate.

Banks offering an MCLR-linked interest rate will review the terms provided to a customer after 6 months; if the other inputs for calculating the MCLR Rate are favourable, a better rate may be offered.

The RBI has reduced the Repo Rate to make loans cheaper and infuse cash into the economy. Loan holders look for immediate relief. How long it takes to lower your EMI depends on the individual terms of the loan and the time stipulated to reset the terms. Banks will examine their fixed deposit rates, current CRR, and profitability. Banks tend to drag their feet when they need to lower interest rates, and the customer profile and payment track are also considered when reviewing the loan terms.

This is a time for upheaval in the mortgage lending scene as customers anxiously look to negotiate better terms for their existing loans and new home buyers wait to compare rates offered by Government Banks and Private lenders. The Home Loan top-up option helps customers renegotiate their loans and apply for surplus funds at a lower rate.

Home loan and Mortgage customers with timely repayment tracks can take advantage of Balance Transfers by transferring the principal balance of their loan to an alternate lender offering lower rates. At the same time, Banks go the extra mile to retain priority customers.

Personal Loans are unsecured funds with short repayment terms, up to a maximum of 72 months. Banks and NBFCs look to fund customers with suitable profiles who make timely repayments, thus ensuring rotation and profitability. The Personal Loan Interest Rates are based on the cost of funds, which includes the RBI repo or repurchase rate, the CRR ratio, deposit rates, and the financiers’ operating expenses. As Personal Loans are issued without securities, Banks must keep the default ratio below the acceptable limits.

Over the past two years, the RBI has increased the Repo Rate twice, but interest rates for an ICICI Bank Personal Loan, HDFC Bank Personal Loan and AXIS Bank Personal Loan remained steady with banks taking the changes in their stride. So, will the .25% reduction of the repo rate encourage Banks to reallocate interest for personal loans as Banks are not obligated to link personal loan interest to the repo rate fluctuations and take time to absorb the changes and consider their portfolio? Further, the interest rate and EMI for a personal loan are fixed at the time of disbursal, and the EMI remains the same; therefore, a variation in the Repo rate will not change the existing rate of your loan.

At a monthly reducing balance, Personal Loan Interest Rates range from 10.80% to 20 %. Banks formulate an individual policy targeting customers according to their preferred segments and applicants with a mutually beneficial relationship. Other primary factors influencing the interest rate include:

Banks face liquidity issues due to the high fixed deposit rates and the downward trend in the savings ratio. If liquidity increases, banks might consider lowering the rate of New Personal Loans to performing segments. How the rate cut is transmitted to the personal loan sector depends on the bank’s policy, the cost of funds, and profit margins.

At this juncture, Personal Loan seekers can look for lower-rate options, and existing personal loan customers can take advantage of a reduced rate by Transferring their loan balance to an external Bank or Applying for a Personal Loan Top-up.

The RBI has reduced the Repo Rate to inject more cash into the economy and make loans more affordable. However, for the benefits to ultimately reach the average borrower, the expectation of relief through a reduced EMI for current obligations and the encouragement of fresh borrowing will depend on how effectively the rate cut is passed down in the coming months.