To make your personal loan journey successful, it is a good idea to seek complete clarity about the details and make an informed decision. This is particularly true if you are a first-time loan seeker or have been unaware of the terms of your previous loan and the costs applicable. Given below are the significant questions you need to ask before securing the best personal loan Deal.

Understanding the purpose of a personal loan is crucial. It’s an unsecured, easily accessible fund that should be used for legitimate financial needs. Having a specific goal and a well-planned repayment strategy not only ensures responsible fund management but also helps improve your credit rating.

The eligibility criteria for personal loans differ between Banks and NBFCs. You should verify which bank considers you eligible to apply before submitting your request. The key criteria include:

Survey the offering and check personal loan interest rates online before applying for a personal loan. The HDFC Bank personal loan interest rates are from 10.25% to 22% and are charged at a monthly reducing rate. The personal loan interest rate, once issued, remains constant for the entire tenure. Looking for the lowest rate is a priority, but it is also essential to check the other costs applicable that will affect your cost of funds.

Though the interest rate is the primary charge, there are other charges you need to be aware of, including:

If you have taken the funds for a short-term need and repay the loan before the term ends, or have funds that you need to contribute towards your principal loan amount, you need to check the costs involved before applying.

The repayment from the following month after a Personal Loan is disbursed and the tenure is fixed from 12 months to 72 months according to the;

A longer tenure reduces your EMI but increases the cost of your loan. You can request a suitable tenure, but the credit team finalises the same upon disbursal of the personal loan.

Before applying for a personal loan, it’s essential to check the affordability of the EMI for repayment. Use the EMI calculator to determine your EMI for the required loan amount. If the EMI seems unaffordable, it’s better to apply for a lower loan amount or opt for a longer tenure. A stretched budget can lead to delayed repayments, so it’s essential to ensure that the EMI is comfortably within your financial reach.

Documents are the foundation for processing your loan. It’s crucial to provide complete and valid documents to expedite the process. As you can personal loan apply online it’s even more critical to ensure that your documents are clear and legible. Being proactive in providing the necessary documents can significantly speed up the loan approval process.

KYC and Income documents accepted for the personal loan process include the following:

A passport-sized photograph.

Income Documents;

Identity proof.

Address proof:

When you apply for a personal loan, the bank sends an inquiry to CIBIL to check your score and history. Each enquiry can reduce your CIBIL score by 10 to 15 points. It is crucial to choose the right lender to process your personal loan application, as applying to multiple lenders can harm your CIBIL score. The best CIBIL score for loan is 750 points.

You can apply for instant personal loan online for quick disbursal. Banks aim to approve and disburse funds as a personal loan within 72 hours, but this requires cooperation from both the Bank and the customer to ensure a smooth process. The customer must provide the Bank with all necessary documents and be available to answer any queries. The Bank’s systems must support the applicant’s submissions and complete the required process steps within the TAT period.

It is always advantageous to apply for a personal loan from a lender with whom you already have a bank account or a prior loan relationship. An HDFC Bank personal loan top-up is a convenient option for urgent funds. Do not be influenced by offers such as those from apps advertising immediate funding but providing funds through a third-party lender; their terms, including the charges, are often unclear.

A personal loan is a suitable choice in an emergency or for personal use, as it is quick and issued without any collateral. Also, do a personal loan eligibility check and check your CIBIL score before applying to ensure you meet the necessary thresholds. You should be able to afford the repayment comfortably, and the EMI must fit within your budget.

If you don’t have a CIBIL score or don’t meet the personal loan eligibility criteria, you can ask for a loan against your fixed deposit to get the funds you need. Taking out a gold loan is also a good option, as you can get funds at a reasonable rate, giving your ornaments as security. A used car loan can also help you get the required funding.

In Conclusion, the terms for a personal loan, which include the interest rate, other fees, and the EMI, are finalised at the time of disbursal and do not change; therefore, you must be satisfied with your decision that you are applying to the right lender and will be able to complete your financial obligations comfortably.

Before approving a personal loan request, the credit officer of the personal loan lenders, such as ICICI and HDFC Bank, will make a telephone call to verify information based on the application form and submitted documents. This might seem like a pre-functionary call to correlate the details given, but the importance of the call should not be underestimated; it could turn the tables for or against your favour.

To avoid facing a decline, let us explore further the questions asked to make your personal loan journey smooth and successful.

One of the essential questions asked by a bank’s underwriter when granting a personal loan is, “What is the amount required and the end usage of the personal loan requirement?” as the timely repayment of EMI is the primary focus of the lender.

Valid reasons for applying for a personal loan include: Home renovation, weddings, family functions, travel and holidays, education expenses, payment of hospital bills, and other medical emergencies.

Expenditures for investment or business usage could lead to misappropriation of funds. Similarly, you cannot use a personal loan for purchasing land or to start a new venture, where there is a monetary risk factor involved.

Let us check out this example to understand this further:

Profile of the customer applying for a personal loan: Aman Sharma, an IT executive at a prominent software firm, applied for a personal loan of ₹ 8 lakhs from HDFC Bank. He maintained a salary account with HDFC Bank, earning a monthly income of ₹ 80,000/-. His CIBIL score was excellent, and he was paying a home loan EMI of ₹ 15000/-. His company is classified under category B of the HDFC Bank company list, and with no outstanding credit card dues, he remains hopeful of securing the loan.

The primary need for funds was for the renovation of his new home, and he had applied for a surplus amount to cover any shortfalls.

Aman was a bit preoccupied at the time of the call and explained that the amount was needed for the renovation of his new home, and he had applied for additional funds, which he would invest in mutual funds if not used. Soon after, he received a message that his loan request had been declined. Although investing in mutual funds was not the actual end use, a mention alerted the Credit officer, who was not convinced about the appropriate usage of funds, which led to the decline.

When you apply for instant personal loan online to ICICI Bank, you need to fill in the application form and submit supporting income and KYC documents. The information filled in the form must match the documents given. You will be asked to verify the same.

The amount granted as a personal loan is based on your monthly income. The net income should easily cover your monthly expenses.

The credit officer will ask you to confirm your income for a personal loan eligibility check, as the EMI for repayment of the loan is calculated with the regular income credits in your Bank account. If you have an alternate source of income, proof of the same must be submitted.

The salary depicted in your salary slip must match the credit in the Bank statement. If there are any discrepancies, for example, if the salary is deducted for a particular month, you will be asked to provide a reason for this with the documentary proof.

Apply for a loan amount that can be repaid conveniently. Suppose the credit manager feels that your income is insufficient or that the balance maintained in your bank account is not enough to support the EMI, you may not receive the loan amount required, or you may be asked for an alternate account if available with a sufficient balance.

Equally important is work stability, which ensures your income is consistent and allows you to pay your personal loan instalment regularly. The credit officer will ask you about your employment history to understand your track record.

Employment with a Category A company, according to the HDFC Bank company category list, reassures the credit manager that you have steady employment and your salary will be credited on the due date, enabling the EMI to be cleared. Whereas if you are employed with a private limited company, you will be questioned about your work history.

The salary slip usually displays the date you joined the company; if the joining date is missing, you will be queried about it and required to provide the appointment letter or Form 16.

The total work experience required for a personal loan is at least 12 months. If you have been in the present organisation for less than a year, you may be asked to provide documentary proof of the previous organisation.

Completion of the KYC details is a necessary mandate issued by the Reserve Bank of India. Your KYC documents must be updated, with clear copies available for the personal loan application online. With the online KYC process becoming popular, your Aadhaar card and PAN card must be legible during the video KYC process.

A personal loan is unsecured funding issued for a limited tenure, without any security or guarantees; therefore, the customer must be easily reachable.

The information given regarding your residence address must be authentic, as there will be a physical verification conducted at the residence.

A self-owned or family-owned residence adds bonus points to your application as it ensures the applicant can be easily contacted, whereas an applicant shifting from rented residences may be harder to contact and so will not be issued a higher loan amount. Applicants living in rented accommodation will be asked for permanent address details, and if need be, documentary evidence will be required.

The applicant must be living at the current address. For instance, an applicant residing in office-provided accommodation and giving his Parents’ home is not acceptable as his current address, and this will be clarified during verification.

Our family is an integral part of our system; an applicant living with a family has the security and support of the family, as compared to a bachelor and the personal loan request is considered more favourably.

The number of members in your family will also affect the monthly budget; on the other hand, other earning family members will contribute to your financial standing. The credit manager will account for your financial responsibilities versus your income when issuing the amount required as a personal loan.

Suppose you specify in the form that you are married, and upon verification of your residence address, it is proven that you are residing in a bachelor’s accommodation. In that case, your application may be withheld until you provide the relevant proof.

The credit officer of the Bank will study your credit history retrieved from the Transunion CIBIL (Credit Bureau of India Ltd) to check your past credit dealings and the secured and unsecured credit availed, including home loans, credit cards, personal loans, and auto loans. By viewing your credit history, the officer of the Bank will have a keen understanding of how you manage credit. Significant questions asked regarding credit include:

As per the new Reserve Bank of India ruling, your credit inquiries are immediately reported to the Credit Bureau. The number of recent credit inquiries must not exceed 5, according to the ICICI Bank eligibility check, as excessive inquiries give the impression that the applicant may be applying for multiple credits in the form of credit cards or personal loans from other lenders, which may be challenging to repay.

The existing EMI you are paying and the credit cards being used are displayed in your credit information report. If there are any defaults in the history or pending accounts, you may have to explain the cause for the same. Any bounces in the past three months of repayment for credit will lead to a decline in the request.

The credit history will reflect the balances of loans and credit cards you are using. If there are any pending credit card bills, you will be asked to clear them before the fresh loan amount is approved. The loans with six or fewer EMI payments pending will not be considered when calculating your personal loan eligibility.

An applicant with a high CIBIL score of 750 or above is the best CIBIL score for loan. Applicants with an on-time repayment history of credit taken will be provided the lowest personal loan interest rates.

You also have the opportunity to explain to the credit officer if there have been any wrong entries in your credit history and the action being taken to verify the same.

The CIBIL of the spouse and the parents is also checked by the HDFC Bank credit team, particularly when disbursing large loan amounts. If there is a default on credit taken, this will affect the applicant’s personal loan approval status.

Finally, you will be asked about the amount of funds required as a personal loan. It is a good idea to check your EMI in advance using the personal loan EMI calculator and apply for the amount you need and can easily repay.

The personal loan amount is sanctioned, taking into account your income, profile, the existing EMI, and your credit card dues. Although the formula applicable is as per the lender’s policy, the underwriter decides the amount approved as a personal loan after reviewing the application, assessing the profile as satisfactory and speaking to the applicant.

With all the documentary evidence of your financial history and credit transactions readily available online, it is in your best interest to provide accurate information, as any discrepancy can raise suspicion and mistrust.

For example, the underwriter asked Ganesh to forward his credit card statement as the bills seemed unusually high. Upon reviewing the statement, the officer denied his loan request as he noticed that Ganesh had made numerous purchases on Gaming Apps.

There is no manual for the questions you will be asked when applying for a personal loan, and it will depend on your individual case history. As the credit officer is experienced in asking the required questions before issuing a personal loan, answer transparently and attentively to get your personal loan approved.

Digitalisation has influenced all aspects of our lives, bringing about a radical change in how we work, communicate, do business and spend money on necessities or entertainment. Gone are the days when one went to Banks to physically deposit funds or draw cash for purchases. Banking systems have now revolutionised with online transfers and payments. Customers can withdraw money from ATMs, pay with credit cards, and transfer funds online with a click. With a mobile phone as a constant companion, the introduction of payment Apps has now added a new dimension to swift and simplified payment systems. These Apps work using the UPI, or Unified Payment Interface.

The UPI (Unified Payment Interface) is a system that allows users to make safe, inclusive and interoperable payments instantly from their Bank accounts using a smartphone. It will enable users to link multiple Bank accounts to a mobile App for making payments.

Payments are made by Apps using the UPI ID through a VPA (Virtual Payment Address), which allows instant transfer of funds between two bank accounts and payments to merchants. Popular payment Apps used in India include Paytm, Google Pay, PhonePe and the BHIM App.

Download a payment App and enter your account details to link your Bank account. To make and receive payments via an App, create a UPI ID or VPA. (Virtual Payment Address). Your UPI ID is common across all Bank accounts and saves you the hassle of disclosing Bank account numbers. You can transfer funds, make payments to other accounts, and use your UPI ID at merchant outlets. The UPI payments system is safe and secure, with two-way authentication; all transactions are to be confirmed using a UPI PIN.

Beginning August 1st, the NPCI (National Payments Corporation of India) has introduced regulatory changes to enhance the UPI system’s dependability, seamlessness, and prevent disruptions.

Checking the Balance of your account: With the rise in digital transactions, individuals feel the need to keep a check on the balance of their Bank accounts. With the facility readily available, constant checks have become a habit. With the increase in the usage of the UPI, to avoid burdening the system, the NCPI has allowed a maximum of 50 checks in a 24-hour roll-out.

Time slots assigned for UPI transfers: Are you paying your telephone or electricity bills through the UPI? It has become a convenient option to pay your bills instantly through a single UPI platform, which provides multiple services. To avoid congestion, the NCPA has ruled that it will now be done as per the time slot allotted for transfers, which could happen during off-peak hours or at night when the system is not clogged.

Limit access to Bank accounts linked with the UPI: The easiest and fastest route to access your Bank account is through the API (Application programming interface) that enables you to view your Bank account through UPI by using the App. According to the new API guidelines, the assigned limit is 25 requests per day per App. In case the account fails to load, a retry is only to be done at the customer’s request.

Limit for autopay mandates: Have you initiated an autopay extension for a credit card, mobile bill, or personal loan EMI? NPCI has set a limit for one attempt with three retries to execute a single mandate. Further, the autopay mandate will only be executed during the non-banking hours, to avoid server overloads and potential outages to the system.

From the 1st of August 2025, your account balance will be displayed on the screen each time you make a UPI payment. This update, introduced by the NPCI, aims to prevent payment failures and eliminate the need to check your balance manually. It will also help to reduce unnecessary pressure on the system and enhance the overall user experience, making it more efficient and customer-friendly.

Taking into account the extensive usage, the NPCA has advised the UPI payment service providers to make the relevant changes by July 31st. The changes will increase efficiency and help in the following ways:

Whether you are using Paytm, Google Pay, or the BHIM App, the UPI payment functions for all the apps are similar. For optimum use of the UPI payments, note the following:

The payment Apps are no longer just facilitating UPI payments but are complete platforms offering a variety of services. They provide links for Travel bookings, offer personal loans on behalf of Banks, and even a free CIBIL score check. They also entice usage by offering bonus points and cash back offers. Therefore, with the backbone of the UPI transactions network, we aim to become a one-stop shop easily accessible at all times through your mobile phone.

Credit cards are today a way of life, driven by the growth of online transactions and the credit industry. Most banks market credit cards, offering benefits and attractive rewards for usage to attract customers.

If you are looking to get your first credit card or want to secure an additional card that offers privileges tailored to your needs, being rejected is a disappointment you want to avoid. It is wise to study the reasons and apply for a credit card the smart way.

Leading Credit card lenders judge a request based on the individual’s policy. Listed below are the eligibility criteria required:

A steady monthly income is the security factor that lenders require, ensuring the credit card user can settle the usage amount on the due date. For salaried individuals, the minimum income requirement is a monthly salary transfer of ₹25000/-, while self-employed applicants must submit an Income Tax return of ₹6 lakhs or more.

The salary slip and the corresponding Bank statement are required as proof. Self-employed applicants need to submit a copy of the ITR and the Banking details of their current account.

If your income is not sufficient, or you cannot provide the documentary evidence required for regular earnings, adopt the following alternatives;

A successful employer can sustain growth and reward employees with timely remuneration. To ensure the applicant can maintain a lifestyle and regular credit card usage, banks compile a list of approved companies. The HDFC company category list, the ICICI Bank-approved list of companies, and the AXIS Bank list of approved companies all contain comprehensive lists of companies ranked according to their priority for sourcing credit cards and personal loans. These lists include reputable companies that feature on the Economic Times 500 list, top companies, profitable organisations, and the government sector.

Your employer should be included in the list of approved companies to obtain a credit card from the Bank; therefore, do check before applying. The employees of the listed companies are issued credit cards readily with a reasonable limit, whereas a credit card application from an applicant working in a non-listed, proprietorship or partnership firm will not be processed further.

Your CIBIL score today is not just a rating, but a reflection of your financial management skills and standing. A good score is the gateway to securing easy credit, whether through a personal loan online or the best credit card in India. The acceptable score to process a credit card varies from Bank to Bank. The minimum score required to apply for an HDFC Credit card is 720 points and above. ICICI Bank and AXIS Bank require a CIBIL score of 750 points and above to issue a credit card.

Most Banks have now adopted a digital strategy for processing credit cards. When entering your details on the ICICI Bank credit card application link, your CIBIL score is accessed online. If the score exceeds the required benchmark, processing will continue; however, if the CIBIL score is not acceptable, further processing will be halted.

Before issuing a credit card, your CIBIL history is reviewed for any recent defaults or credit applications to other banks, as well as other credit enquiries. ICICI Bank allows a maximum of three enquiries in the past three months. If the number of enquiries exceeds this limit, the Bank assumes that the customer intends to take multiple credit cards and may not be able to repay debts; hence, the credit card request is declined.

If your profile meets the primary criteria required by Banks for a credit card, listed below are some reasons why your credit card application may be rejected.

Discrepancy in documents: The KYC and income documentation provided must be clear and valid. Take note of the following to avoid delays.

KYC Verification: ICICI Bank conducts a video call with the customer to verify the KYC documents. The applicant is required to show the original PAN Card over the call and verify the signature. To conduct a successful verification online, take note of the following:

Employment Verification: An email from the applicant’s official email ID is considered sufficient proof of official verification if the applicant is unable to provide the same; a physical verification is conducted at the applicant’s office premises to confirm availability.

Overleveraged Customer: If your CIBIL score is above the required benchmark, your income is sufficient, and you are employed with a listed company, your credit card request may be declined if your credit history displays high existing obligations, such as credit card dues or EMI payments for loans.

The credit card interest rate for dues ranges from 36% to 42% per annum. If you are unable to settle your credit card bills, the amount can increase due to the high interest rate involved. When the EMI for your loans exceeds 50% of your income and you have credit card outstanding balances, the risk of defaulting on repayments rises; consequently, your request for an additional card may be refused because you are overleveraged.

In Conclusion, your credit card comes with the responsibility of judicious usage and timely repayments. If you need a credit card, apply to the lender with a policy best suited to your usage. Hereafter, taking the time to understand the eligibility requirements you need to fulfil will go a long way in avoiding rejections.

Personal loans are unsecured funds, issued without collateral or guarantees for personal use. HDFC Bank offers loans ranging from ₹1 lakh to ₹50 lakhs, to be repaid over a tenure of 12 to 72 months through EMI or equated monthly instalments.

To facilitate the quick processing of personal loans to the salaried segment, HDFC Bank has developed a methodology that is applied based on the customer’s profile, enabling the calculation of loan amounts that can be issued as personal loans. The system has been established, drawing on years of experience in lending personal loans, to minimise defaults and help eligible applicants access the maximum funds.

The HDFC Bank eligibility calculator, for the personal loan amount, takes into account the following criteria;

Using the above customer profile inputs, HDFC Bank employs a combination of the Multiplier and FOIR methods to determine eligibility for the personal loan amount. The following are the significant features of Multipliers and FOIR that are used.

HDFC Bank has assigned multipliers to determine the loan amount an applicant is eligible to receive. The multipliers are applied based on the applicant’s net salary and company category.

Refer to the illustration below for multipliers applicable to a salary of ₹50,000 and above.

| Company Category | Multiplier |

| Category A | 30 |

| Category B | 25 |

| Category C | 20 |

| Category D | 12 |

HDFC Bank applies a higher multiplier to applicants with a monthly salary of ₹50,000 and above as per the illustration above. Therefore, an applicant employed by a Cat A company and earning a net income of ₹60,000 per month is eligible to receive a maximum loan amount of ₹18 lakhs (provided the other eligibility criteria are met), whereas an applicant earning ₹60,000 and working with a Cat C company can obtain a maximum of ₹12 lakhs.

The HDFC Bank multiplier applicable for an income of ₹30,000 to ₹49,999 is commensurate with the funds an applicant can spare after fulfilling the mandatory expenses. As illustrated below, a Category B employee with a net salary of ₹40,000 is issued a loan amount of ₹720,000. In contrast, a Category D employee with a similar salary will be issued a personal loan of ₹ 400,000 from HDFC Bank.

| Company Category | Multiplier |

| Category A | 20 |

| Category B | 18 |

| Category C | 15 |

| Category D | 10 |

The multipliers are applied based on the customer’s income and company category to calculate the amount that can be issued to the applicant. However, the multipliers are not the final decision-makers, but rather indicators that take into account the applicant’s profile. The next step is to verify the customer’s existing obligations, including the EMI for existing loans and credit card dues, as well as the EMI the customer can comfortably afford to pay.

Application of the FOIR (Fixed obligations versus the income received).

The FOIR is applied in a personal loan to determine the disposable income an applicant has available after covering the mandatory monthly expenses. HDFC Bank applies the FOIR by the following specifications.

The net salary of the applicant: The net income of an applicant will determine the ratio of spending on monthly expenses and the spare funds available for other personal expenses. For example, an applicant earning a net income of ₹50,000 per month is likely to have more spare income for purchasing the latest gadgets compared to an applicant earning ₹30,000 per month. Therefore, a higher FOIR is applied to applicants with higher incomes.

The Company category of the employer: Employees of companies listed in the A and B company categories of HDFC Bank are well-qualified and have secure jobs with promising prospects. They are expected to meet their obligations punctually and therefore receive a higher FOIR compared to applicants employed in companies categorised as Category C or D.

| Company Category | Net Income | FOIR |

| Category A | >₹ 50k | 70% |

| Category B | >₹ 50k | 70% |

| Category C | >₹ 50k | 60% |

| Category D | >₹ 50k | 50% |

| Category A | > ₹30k | 50% |

| Category B | > ₹30k | 50% |

| Category C | > ₹30k | 50% |

| Category D | > ₹30k | 50% |

Illustration of the calculation for a loan amount as per the HDFC Bank eligibility calculator, applying the multiplier and FOIR method.

Komal is an HR executive working for a private limited company listed as Category C in the HDFC Bank company category list. She earns a net salary of ₹70,000 and is seeking the maximum amount she can obtain as a personal loan. Let us examine her eligibility amount from HDFC Bank.

| Company | Net Salary | Multiplier | Eligibility | |

| CAT D | ₹ 70,000/- | 12 | ₹ 8.40 lakhs | |

| FOIR Applied | Can pay EMI | Tenure applicable | Eligibility | |

| 50% | 35000/- | 48 months | ₹16,80,000 |

According to the FOIR, Komal is eligible for a personal loan amount of ₹16,80,000 from HDFC Bank, but the multiplier for the company category restricts her to ₹8,40,000 as a personal loan. In similar circumstances, the multiplier will override the FOIR, and the loan amount issued to her will be restricted due to the category of the company with which the applicant is employed.

The customer may be earning a handsome salary, employed by an elite company, possess an acceptable CIBIL score, and be eligible for a maximum loan amount of ₹10 lakhs or more; however, the existing obligations, including EMI payments and credit card dues, are factored in before finalising the loan amount. The CIBIL report is verified for loans in progress and existing credit card dues. After applying the FOIR, the EMI payments are noted as per the CIBIL, as are the credit card dues. Depicted, as per the illustration below;

Dinesh Singh, an employee of a company featured as CAT B in the company category list, earns ₹45,000 per month. He has applied for a loan of ₹5 lakhs to renovate his home. He is currently paying an EMI of ₹ 6,000 per month for an auto loan. Let us verify if he is eligible for the required loan amount according to HDFC Bank’s eligibility criteria.

| Net Income | ₹45000/- |

| FOIR of 50% | ₹ 2250/- |

| Existing EMI | 6000/- |

| Eligible to pay an EMI of | 16500/- |

Thus, Dinesh qualifies for his Personal loan requirement of 5 lakhs under the following terms.

Using an EMI calculator to check the EMI with the input of the loan amount and tenure will help applicants to pre-check if they can comfortably afford the instalment.

Thus, the HDFC Bank has a clear and concise policy that enables the disbursal of personal loans with speed and efficiency. With the advent of digitalisation, HDFC Bank has created online mechanisms to facilitate speedy processing, helping eligible applicants apply for a personal loan and submit documentation online.

Although the HDFC Policy for calculating the personal loan amount that can be issued to an applicant is clearly defined, the decision rests with the credit team, who will speak to the customers and verify details to approve the personal loan. Ultimately, it is the comfort of the credit team in approving the loan amount required that matters.

A Personal Loan serves as a solution for funding emergencies or covering shortfalls in expenses, such as family celebrations, weddings, or holidays. Additionally, Personal Loans are unsecured and may be used for home renovations and educational costs. When Applying for a Personal Loan, the applicant must ensure that the amount applied for is well within the repayment capacity to avoid future delays or defaults.

HDFC Bank Offers Personal Loan amounts ranging from ₹1 Lakh to ₹50 Lakhs for salaried individuals, depending on the net income and other obligations. The loan amounts are generally determined based on a customer’s monthly income and their ability to pay the monthly instalment.

An applicant can apply for the loan amount required however, the criteria for approving the funds issued as an HDFC Bank Personal Loan for Salaried Employees are governed by HDFC Bank’s Policy. By segmenting the performing ratio, HDFC Bank allocates funds based on the following criteria:

Company Category According To The HDFC Bank Company Category List:- Your employer must be featured in the Approved List of Companies of HDFC Bank to process a Personal Loan. The HDFC Bank classifies companies into A, B, C, and D based on their net worth, turnover, and prospects. Their listings on the stock exchange and the Economic Times 500 list, as well as Government-Funded and publicly owned undertakings (PSUs), are included in the preferred list.

Employees of premium companies, included in the CAT A and CAT B company categories, are predicted to have a steady income and stability of employment and are granted higher loan amounts with more favourable terms compared to those employed by a CAT C company. According to HDFC Bank’s policy, the loan amount and tenure allotted to lower-category companies are capped.

For example, Ravi, who works in a Category A company and receives a monthly income of ₹50,000, is eligible to receive a loan amount of ₹15 lakhs. In contrast, Parul, who earns an income of ₹50,000 but is employed with a CAT C company, is eligible for a maximum amount of ₹10 lakhs.

Net Income:- The net income is a significant factor that affects the monthly EMI you can afford to pay for the loan amount. The income segments are divided according to the net income:

Applicants with an income of ₹75,000 or more are classified in the elite category and are eligible for unsecured Personal Loans of ₹15 Lakh or above from HDFC Bank.

The minimum salary requirement is ₹30,000, which must be deposited into the bank account every month via electronic transfer. The percentage of the income allotted by HDFC Bank towards the EMI increases in proportion to the salary received, as per the applicable multiplier. A higher income indicates that the applicant has more disposable funds at hand and can afford to pay a higher monthly EMI for a Personal Loan.

HDFC Bank Personal Loan CIBIL Score and History:- HDFC Bank is among the leading lenders offering Personal Loans without a Credit history. If the applicant is a first-time borrower, the bank will offer lower loan amounts, providing the applicant with the opportunity to establish a credit history.

For existing credit users, a CIBIL Score of 730 or higher is required to process a Personal Loan from HDFC Bank. HDFC considers the applicant’s credit history and current EMI when determining the loan amount. A strong repayment history of existing loans encourages the Bank to approve the requested loan, while delayed repayment and bounced payments may lead to rejection.

Before finalising the loan amount, the CIBIL record is checked for existing credit and the EMI being paid by the applicant. This includes all mortgages, loans against commodities and credit card spending. If the existing obligations exceed the percentage of income allotted toward credit, the customer is declared overleveraged, and the Personal Loan Request is Rejected.

HDFC Bank also notes the number of inquiries in CIBIL when reviewing the applicant’s credit record. If there are too many recent inquiries, it indicates that the applicant has applied for credit simultaneously to multiple financial institutions.

Excessive inquiries are viewed negatively because they suggest the applicant may be under financial stress or trying to secure funds from multiple banks, which may indicate an inability to repay the loan on time.

Credit Cards are convenient spending tools that allow users to utilise funds within the assigned limit and make repayments after a grace period of 45 to 50 days. A statement detailing the expenditure is sent to the customer for repayment on the due date. If unable to pay the full amount, a payment of 5% or the minimum dues must be made. The remaining balance is carried forward to the next cycle, subject to a finance charge of 36% to 42% per annum.

Applicants with unpaid Credit Card dues may face high interest rates. If there are outstanding balances on multiple cards, it may indicate that the applicant is experiencing financial difficulties. Therefore, the CIBIL Report is reviewed to determine the number of Credit Cards the customer holds and any pending dues. The HDFC includes 5% of the pending dues in the customer’s obligations. If the total due on the Credit Cards exceeds 5 times the customer’s income, the request is declined. For example:

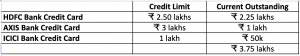

Dinesh earns a monthly net salary of ₹ 40,000. He holds Credit Cards from HDFC Bank, ICICI Bank, and Axis Bank with the following details.

As per the above details, Dinesh has a current outstanding of three lakhs seventy-five thousand across all three cards. With an annual interest rate of 36%, the applicant will be charged ₹ 1,35,000 annually or ₹ 11,250 per month as interest.

Besides the principal factors such as the Income, Company Category, and the CIBIL Score, the other factors taken into consideration include:

The Applicant’s Age:- Young applicants aged 23 or older who have recently been employed and are first-time loan seekers are offered a limited amount as a Personal Loan. Applicants above 53 years of age are offered a Personal Loan From HDFC Bank with a repayment tenure based on their remaining years of service.

An HDFC Bank Relationship:- Personal Loan applicants who have a salary account with HDFC Bank, or an existing loan or Credit Card, and have a proven track record of timely repayments are eligible for higher loan amounts.

Co-applicant Benefits:- HDFC Bank accepts spouses or parents as financial co-applicants. If a customer’s loan amount needs exceed what they can afford with their current income, the co-applicant’s income is added to boost eligibility. The co-applicant must meet the Eligibility Criteria of HDFC Bank terms and conditions to be accepted as a co-applicant.

The maximum loan amount an applicant can receive from HDFC Bank depends on the profile, net income and the percentage of revenue that the applicant can dedicate towards repayment or the monthly EMI.

Applicants can request a lower amount after a Personal Loan is Approved however, if they do not receive the required loan amount, they can request a relook, but this may mean they are not eligible for a further amount.

The repayment tenure for an HDFC Bank Personal Loan ranges from 12 months to 72 months and is allotted according to the applicant’s eligibility to pay the EMI. A shorter tenure will lower costs, but a longer tenure will allow the applicant to get increased funding.

Using the EMI Calculator, applicants can calculate the EMI for the required loan amount, which helps them determine a suitable loan amount and tenure for their application.

An applicant can reapply for a Personal Loan to HDFC Bank after 30 calendar days.

An applicant can increase the Eligibility for a Personal Loan by repaying credit card bills due and by Applying for a Balance Transfer of an external Personal Loan to HDFC Bank.

An applicant can apply for further Personal Loans to HDFC Bank after suitable intervals; the loan amount issued will be according to the applicant’s existing profile, CIBIL score, and existing obligations.

To qualify for an HDFC Personal Loan of ₹ 20 Lakhs, an applicant must meet the following eligibility criteria:

To Receive a Personal Loan Amount of ₹ 10 Lakh, The Applicant Must Fulfil The Following Criteria:

An applicant employed by a CAT D Company is eligible for a maximum Personal Loan of ₹ 15 Lakhs from HDFC Bank.

With a bid to gain a spot among the top lending brackets, YES Bank has opened up tremendous opportunities in the retail lending and banking sector with a comprehensive and customer-friendly approach. It has fostered a stable and progressive environment for the salaried class to meet their financial needs whenever required with a Personal Loan from YES Bank.

The YES Bank Personal Loan Eligibility Criteria make funds easily accessible and affordable for the salaried class. Listed below are the reasons that position YES Bank as your preferred lender for Personal Loans compared to other banks.

CIBIL Score Requirement: The CIBIL requirements for lenders have become a standard for most banks when processing personal loans. A CIBIL Score of 720 to 750 Points is mandated according to the specific eligibility criteria of the bank or NBFC. For instance, to fulfil the ICICI Bank Personal Loan Criteria, the applicant’s CIBIL Score should be 750 or higher.

The YES Bank Personal Loan CIBIL Score: The acceptable CIBIL Score for a YES Bank Personal Loan is 700 points or above. If you have not been able to use a Credit Card and your CIBIL Score has actively remained around the 700 mark, you may still be eligible to apply for a YES Bank Personal Loan. The condition is that there must not be more than three inquiries in your CIBIL record to avoid multiple borrowings.

Criteria for Personal Loans with Listed Companies: A Personal Loan Application for HDFC Bank is processed only if the applicant’s company is listed on HDFC Bank’s Approved Companies List. Similarly, the Eligibility Criteria for Personal Loans at ICICI Bank also require the applicant’s employer to be included in ICICI Bank’s List of Approved Companies. Additionally, NBFCs usually charge higher interest rates to applicants who are employed by non-listed companies.

The YES Eligibility Criteria for Employment: The YES Bank publishes a comprehensive list of approved companies for sourcing personal loans. Companies are categorised as CAT A, B, and CAT C according to the priority for lending, with CAT A being the preferred category. The YES Bank is the only primary Bank that entertains personal loan applicants from non-listed companies. If the company meets YES Bank’s Loan Eligibility Criteria, it is listed under the relevant category. Therefore, applicants working with non-listed companies need not despair the YES Bank Personal Loan for Salaried Employees is available to them if their company meets the YES Bank Personal Loan Eligibility Criteria Check.

Income Criteria For Salaried Employees: The minimum salary required to process a Personal Loan from HDFC Bank is ₹30,000, which must be transferred to the bank. ICICI Bank requires a minimum salary of ₹40,000 for applicants employed by listed companies. Most lenders issue personal loans to high-income applicants, with no flexibility regarding the salary transferred.

YES Bank Personal Loan for Salaried Employees: The YES Bank Personal Loan minimum salary requirement is ₹ 25k and above, which is more reasonable compared to other Banks. The lower salary parameter enables applicants who are earning a basic salary or have just started their career to borrow funds for personal use via a Personal Loan at YES Bank. The salary criteria are acceptable across company categories as per the YES Bank Company Category List.

Apply for a YES Bank Personal Loan Online: YES Bank offers a comprehensive online processing facility for Personal Loan applicants. Documents can be uploaded online with the details required for the YES Bank Instant Personal Loan.

YES Bank Personal Loan Interest Rates: The interest rate charged for a YES Bank Personal Loan varies according to the approved loan amount and the applicant’s company category. The minimum interest rate is 11.50%, with a maximum of 16%.

Maximum Loan Amount: Personal Loan amounts of up to ₹50 lakhs are available to eligible applicants employed in a category A company. Multipliers determine the loan eligibility based on the company’s category. Applicants can calculate a suitable EMI using the YES Bank Personal Loan EMI Calculator.

A Personal Loan from YES Bank caters to the entire salary segment and offers unsecured funds for various personal and emergency needs. The approved loan amount is transferred to the account and can be used as needed, providing the loan holder with the freedom to utilise the funds as desired. With numerous benefits offered, the instant online YES Bank is now the preferred Option for a Personal Loan.

Personal Loan Request Decline Reason: The customer is overleveraged (does not meet the eligibility criteria of the Bank). Here is a comprehensive explanation of how we assisted him in obtaining the required loan amount after the Bank had declined the request.

The Customer’s Predicament: Nitesh Sharma, a young professional with a management degree, is employed in the insurance sector. He applied for an HDFC Bank Personal Loan of ₹3 lakhs, as he was falling short of funds for his wedding expenses, the date was approaching, and arrangements needed to be made. He was confident of getting the amount as his CIBIL Score was above the acceptable benchmark.

Therefore, it came as a surprise to him when his application was declined as being ‘overleveraged”. A customer is considered overleveraged if the Bank believes that the applicant, with their existing obligations, will be unable to afford further credit.

Steps to a Solution: Nitesh reached out to us by completing the Personal Loan Request form on our website. When our loan advisor contacted him for clarification, he was forthcoming about the issue he had encountered.

Listed below are the profile details of Nitesh Sharma that are considered for a personal process.

Calculating Eligibility: Most banks employ the FOIR (Fixed Obligation against Income Ratio) method to determine loan eligibility. Based on the income and the company category listed in CAT B as per the HDFC Bank Company Category List, he is eligible to allocate 50% of his income towards credit dues.

As of the current status, he was paying an EMI of ₹ 25,093, which was declared insufficient for an additional loan amount. Therefore, his HDFC Bank Personal Loan Application was declined.

The Answer: According to his profile specifications, he is eligible to Apply for a Personal Loan. He shared the necessary Personal Loan Documentation with us, which includes the KYC and income documents. The documents were all in order, and upon reviewing the bank statement to match the incoming and outgoing payments, we noted that he was paying an EMI for a home loan.

Finding a way to assist him in securing the necessary funds was urgent because he had already earmarked them for the forthcoming celebrations. We reviewed the specifics and inquired about the details of his credit and found the answer.

A home loan is always granted with a co-applicant, and in Nitesh’s case, this was his father. Furthermore, according to policy, if the co-applicant is an earning member, half of the EMI for a home loan is allocated to them.

We requested that he submit his father’s KYC and bank statement, and we subsequently submitted his Personal Loan Application to ICICI Bank, along with the necessary documents for processing. After allocating 50% of the Home Loan EMI to his father’s account (₹ 12546.5), he is now Eligible for a Personal Loan based on the following eligibility calculation.

Thus, following the submission of his father’s proof of documentation, his Eligibility for a Personal Loan was established, and he was granted a Personal Loan of ₹ 3 lakhs from ICICI Bank. He had calculated the applicable EMI in advance using our EMI Calculator and was satisfied that the EMI would be easily affordable.

Nitesh was relieved that he had managed to acquire the necessary funds on time, and assisting our customers in obtaining their desired funds is the goal we strive to achieve.

In conclusion, when a loan seeker contacts us, our first step is to understand the customer’s profile, their requirements, and their credit history. In contrast, banks assess the case based on the available documentation and the applicant’s data.

We strive to find ways for customers to obtain the necessary funds to address emergencies or immediate needs. The satisfaction of helping applicants meet their financial obligations is immense. Our years of experience and in-depth understanding of the Personal Loan Process provide a valuable asset to our customers, enabling us to offer innovative solutions that consistently exceed expectations.

AXIS Bank has established a legacy of consistent growth and is synonymous with trust, offering a range of banking and retail finance services, including secure and unsecured loans.

Personal Loans from AXIS Bank are easily accessible and disbursed with speed. Over the years, the AXIS Bank has created a niche for itself in the Personal Loan segment. As Personal Loans are provided without security, the Bank must ensure that repayments are received promptly. To this effect, an applicant must fulfil the eligibility criteria to obtain a Personal Loan from AXIS Bank. Listed below are the AXIS Bank Personal Loan Eligibility features:

The applicant must be over 23 years of age and may repay the Personal Loan until the age of 62. They must be gainfully employed, earning a regular income, and have at least two years of work experience. The Axis Bank Personal Loan minimum salary requirement is ₹25,000 or more, as per the Axis Bank Personal Loan Eligibility Criteria.

Employment Criteria: The applicant’s employer must be listed in the AXIS Bank Company Category of Approved Companies for sourcing Personal Loans. If you hold a salary account with AXIS Bank, your request is processed if you are employed with a Non-Listed Company.

CIBIL Score and Credit History: The applicant’s CIBIL Score must be 750 points or above, and there should be no significant aberrations in their CIBIL History. If the Axis Bank Personal Loan Eligibility CIBIL Score is above the required benchmark and the Application score is met, the applicant is processed further.

Application Score: AXIS Bank has its eligibility criteria and provides an application score online once the customer details are submitted. If the system approves the application, the process will continue otherwise, the request will be denied.

Loan Amount: The loan amount is calculated based on the applicant’s net income and current obligations, including EMI payments for other loans and Credit Card debts. The method used is the FOIR, or fixed obligations against the income ratio.

Illustration of a Calculation as Per the FOIR Method

The applicant is eligible to pay an EMI of ₹ 5,000 per month. By using a Personal Loan EMI Calculator, applicants can select a suitable tenure and verify their Personal Loan Eligibility. According to the specifications above, the applicant qualifies for a Personal Loan amount of ₹ 225000/- with a repayment tenure of 60 months.

Interest Rate for Axis Bank Personal Loan: The Interest Rate for a Personal Loan from AXIS Bank is issued based on the following.

The company category of the applicant’s employer, according to the AXIS Bank Company Category List, is classified as follows: Cat A is the premier category, Cat B includes other limited and government organisations, and Cat C features other eligible companies.

The Personal Loan amount approved by AXIS Bank carries an interest rate starting at 10.69% on a diminishing balance for loans of ₹15 lakhs and above, available to applicants employed by a CAT A company. In contrast, an applicant employed by a CAT C company is offered an interest rate of 15% for a loan of ₹2 lakhs.

The Axis Bank Personal Loan Interest Rate for salary account holders is discounted, and the best terms and conditions are offered to those with a vintage salary account at AXIS Bank.

Personal Loan Balance Transfer: AXIS Bank offers to take over an existing Personal Loan via a Balance Transfer. The eligibility criteria for a Personal Loan Balance transfer to AXIS Bank are as follows:

Personal Loan Top-Up: Existing AXIS Bank Personal Loan holders can apply for an additional amount as a Top-Up to their existing loan, subject to the following terms and conditions of the AXIS Bank Personal Loan Top-up Eligibility.

Personal Loan offers from AXIS Finance: AXIS Finance, a wholly owned subsidiary of AXIS Bank, offers Personal Loans to customers who are not able to meet the Eligibility Criteria of Banks. The assistance provided by AXIS Bank is as follows.

CIBIL Score Below 750 Points: AXIS Finance accepts applications for a Personal Loan with a CIBIL Score of around 700. Helpful for applicants who have not been using credit extensively or have been unable to build a Credit Score due to other reasons, unless the applicant is a defaulter or has current payment bounces. AXIS Finance considers the case on its merits. The applicant must fulfil the eligibility criteria of AXIS Bank Personal Loan Eligibility for salaried individuals.

Balance Transfer of Credit Card Dues: An overdue Credit Card bill attracts a finance charge of 36% to 38% per annum. If unable to pay the amount, it can spiral and lead to a debt cycle. AXIS Finance offers a personal loan for paying Credit Card dues. With a reasonable interest rate and a suitable tenure, Credit Card dues can be paid with a Personal Loan. This offer is available to applicants whose profile meets the Eligibility Criteria of AXIS Finance.

AXIS Bank is now competing with leading retail lending providers, such as HDFC Bank and ICICI Bank, by offering applicants the ease of processing and the convenience of an AXIS Bank Personal Loan Eligibility Check Online. The Axis Bank Personal Loan Eligibility Calculator integrates these inputs, which encompass individual, professional, and financial aspects. Fulfilling this criterion is essential to process an application for an AXIS Personal Loan.” At Yourloanadvisors.com, we strive to provide comprehensive information to our valued customers about the factors that influence Eligibility for a Personal Loan from AXIS Bank.

The CIBIL Score of an individual has become a universal requirement for issuing all kinds of credit. A Credit Score of 720 to 750 Points is a stepping stone to receiving secure and unsecured credit, such as a mortgage, Personal Loan, and a Credit Card. Though a CIBIL Score has become popular as a benchmark, your credit history or CIBIL Record is equally or more important, as it is the basis for calculating your CIBIL Score. There could be a situation where the CIBIL Score is around 730, but the request for a Personal Loan is declined due to aberrations in the credit history. Analysing the CIBIL Report vs Credit Score will help us further understand the functions and implications.

A CIBIL Score is a numeric value issued to an individual by CIBIL (The Credit Bureau of India Ltd), signifying the individual’s creditworthiness. The score value ranges from 300 to 900 points and is issued based on the following:

Banks require a CIBIL Score of 750+ points to issue a Personal Loan, though the CIBIL Score must meet the requisite benchmark both the CIBIL Score and CIBIL or Credit History are checked before issuing a Personal Loan.

The Transunion CIBIL (Credit Bureau of India Ltd) commenced operations in India in 2007. It was the first credit agency to initiate the recording and maintenance of individuals’ and companies’ credit usage. Credit issuing organisations, including banks, NBFCs, and finance companies, forward data on credit issuance and repayment on an ongoing basis to CIBIL.

The CIBIL, in turn, maintains an exhaustive record under the customer profile specifications. Upon inquiry, this data is shared with Banks whenever a customer requests a credit.

So, ever since it started operations, your credit history, whether taken as a Loan or a Credit Card, and the number of times you applied for credit are included under the profile created and the control number issued. A Credit Report or history is updated within a week or fifteen days after a lender reports a credit activity. A CIBIL History contains the following information:

Implications:- The EMI being paid and the outstanding Credit Card balances are taken into account when calculating the financial eligibility for an additional loan amount. The applicant’s existing obligations, net salary, and company category according to the Approved List of Companies are the main factors used to determine Personal Loan Eligibility.

Implications:- The closed accounts reflected in the applicant’s CIBIL History are evidence of adept financial management and add value to the Credit Score. The length of the account is also significant as it certifies that the user has been able to maintain a steady repayment schedule. A financer with credit that a customer has successfully used will be ready to issue further credit when required.

Implications:- A pending account is akin to a thorn in the flesh the amount will accrue interest until it is fully paid, adversely affecting the CIBIL Score. If there is a dispute or an incorrect entry in CIBIL, the customer can bring the matter to attention and seek clarification. The applicant must settle the outstanding dues before any credit can be granted.

Implications:- According to CIBIL, a written-off or settled account is regarded as a negative remark, resulting in a dip in the score, and the customer will not be granted further credit. Customers may have the misconception that paying the original amount and availing themselves of a settlement option will help alleviate the pressure and clear the debt however, this is not the case. A settlement will only offer relief from collection agents, but the CIBIL is marred forever.

Implications:- A payment delay due to a shortage of funds or an oversight cannot be mitigated and is always reflected in the CIBIL History. An infrequent delay in payments is overlooked, but a continuous string of delays will affect the CIBIL Score and give the impression that the applicant is not vigilant about paying dues on time.

Implications:- Banks and NBFCs must send customer data to CIBIL every fortnight. If the CIBIL Report indicates that the applicant has made multiple queries quickly, the Credit Score decreases by 10 to 15 points with each inquiry. Banks are also wary of extending credit to customers who may seek funding from multiple institutions and struggle with repayment. Your application for an ICICI Credit Card is declined if there are more than five enquiries reflected in your CIBIL, and your Personal Loan Application to HDFC Bank can get rejected due to multiple enquiries. Therefore, please do not apply to too many lenders simultaneously, as it can hamper your credit standing and give a wrong impression to the lender.

Banks will examine your credit history to gauge your credit management skills. This may surprise many who applied for a home loan a decade ago or briefly used a Credit Card without notifying the lender of their discontinuation of its use. There may be outstanding dues reflected in the account that could be a deterrent. A CIBIL Score above 730 points can initiate your Personal Loan Process, but a valid explanation is required if there are any irregularities in your credit history.

CIBIL History:- Your credit report or history, which lenders review, includes all credit usage from when you first acquired credit to the present. Once an entry is made, it cannot be altered or removed unless the lender updates it or there is an error in the Credit Report that is corrected.

Credit Score:- Your Credit Score is reassessed based on constant usage and the corresponding entries in your CIBIL record. It will increase or decrease according to the individual’s credit behaviour. For instance, if you limit your Credit Card usage and do not utilise any other form of credit, your Credit Score will remain steady. However, your score will change if you Apply for a Loan or resume using your Credit Card while making timely payments.

CIBIL History:- Your Credit History features years of credit usage, including repayment tracks and current credit. As per the recent Reserve Bank of India directive, Banks will now consider a credit history of 5 years instead of 7 as was previously done for the issuance of further credit.

CIBIL Score:- Your Credit Ratings will improve with credit usage. If you are a current credit user with a good mix of unsecured and secured credit, your CIBIL Score goes up accordingly. In contrast, if there is a delayed payment or current bounce in your record, the CIBIL Score will immediately reflect the same.

Credit History:- Your Credit History shows the EMI you are paying for all your existing loans and Credit Cards. If your credit card balance is unpaid more than your monthly income, and the total EMI you are paying will exhaust more than 60% of your income, your request for further credit is rejected due to being overleveraged.

CIBIL Score:- If you are paying the EMI for your loan on time and the minimum due on your Credit Card Bills, your CIBIL Score will not dip unless you apply for credit several times, and the credit inquiries reflect in your CIBIL History.

Today, lenders are delving into the applicant’s credit history to examine past credit dealings before issuing a Personal Loan. It is a good idea to solve past situations when your obligations could not be fulfilled due to financial shortages, as banks remain open to negotiation. If there have been delays due to unusual circumstances, as in the case during COVID, when many faced a financial crunch due to loss of employment, a leeway can be given. Otherwise, making amends by clearing outstanding dues will stand you in good stead.

Check Your CIBIL Score and credit history regularly, as you are entitled to a free Credit Score and a Credit Report from CIBIL. A CIBIL Score above 750 points signifies healthy credit usage. It is the benchmark used by lenders as a scoring model and gives applicants the indication that their finances are in good shape.

Our past credit dealings are a window into your future credit behaviour. Therefore, a sound credit history will help you obtain credit easily when required at the lowest interest rate, the most suitable terms, and an optimum CIBIL Score.