July 15, 2016

July 15, 2016

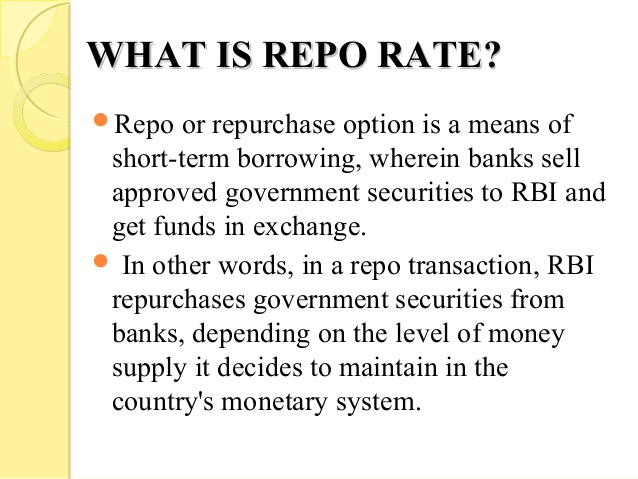

Repo Rate is the rate at which a country’s central bank (RBI in the case of India) lends money to commercial banks in case of any shortfall of funds. A Repo Rate is a Repurchasing Option or Repurchase Agreement for funds given to commercial Banks by the Central Bank as loans against government bonds or securities deposits. The funds are repaid with interest according to the Repo Rate issued by the Reserve Bank of India.

Repo Rate is used by monetary authorities to control inflation. An increase in the Repo Rate will restrict liquidity and control prices, whereas a lower Repo Rate facilitates borrowing. A higher repo rate increases the interest rate of the loans forwarded by commercial banks, whereas a lower repo rate will help reduce the cost of funds. The Reserve Bank of India declares a current Repo Rate, taking into account the state of the economy.

Commercial Banks request funds from the Central Bank in exchange for their government bonds and securities when in need of funds, which are repurchased at a marginally higher price. Banks further utilise funds for running their business and issuing funds as loans. Therefore, the current Repo Rate is the basis for all types of loans, including secure loans such as home loans and Loans Against Property, unsecured loans, Personal Loans, and Credit Cards. As the Repo Rate increases, your Home Loan will cost you more, and vice versa.

The RBI has implemented a system of Repo Rate-Linked mortgages to enhance transparency in lending to customers, especially for loans with longer tenures, such as home loans and mortgages, which are provided at a floating interest rate. The current lending frameworks available for mortgage loans include the EBLR and MCLR methodologies.

The EBLR, or External Benchmark Lending Rate, is directly linked to the external benchmark of the Repo Rate. It was incorporated in October 2019 to give customers the direct effect of changes in the Repo Rate. If the Repo Rate is cut, the impact will be passed on to customers with a home loan or mortgage. Similarly, the customer will be charged a higher interest if the Repo Rate Increases.

Banks add a spread over the external benchmark or Repo Rate to determine the EBLR offered to customers; the spread added comprises of:

Therefore, the EBLR Rate issued to the customer includes Repo Rate + Spread = Interest rate. Banks must reassess the EBLR Rate issued to customers every three months, per the Repo Rate or the 91-day treasury yield. This methodology, though transparent, is volatile and has been adopted by leading PSU Banks such as the SBI (State Bank of India) and Union Bank.

Most Banks adopt the MCLR, or Marginal Cost of Funds Lending System, based on the Repo Rate and other factors. The minimum benchmark set by the RBI (Reserve Bank of India) is also considered. As per the MCLR system, banks have more flexibility in calculating the costs and can factor in their current deposits and profits.

However, it is slower in responding to changes in the Repo Rate and reviewing the rates offered to customers yearly. On the other hand, customers are also comfortable paying a steady EMI for a while. The interest rate offered to an applicant as per the MCLR regime depends on:

The RBI (Reserve Bank of India) closely monitors the MCLR rate forwarded by most private Banks, such as the HDFC Bank and Axis Bank.

Home Loans and Mortgages are issued at a floating interest rate for a longer tenure, so applicants must be vigilant about the current Repo Rate and any fluctuations afterwards. Fresh Applicants are offered a lower interest as a sales call for their Home Loan. The interest rates are later increased if the cost of the bank’s funds increases. If the benefits of a lower Repo Rate are not offered to a Home Loan Applicant, the customer can choose a Balance Transfer to an external bank that provides greater transparency.

Short-term loans, auto loans, Business Loans, and Personal Loans come with a fixed interest rate and monthly EMI at the time of disbursement. According to its policies, the bank determines the interest rate based on its fund cost, including the Repo Rate and added margins. If the interest rate changes, the applicant has the option to transfer the loan amount through a Personal Loan Balance Transfer to an external bank offering better terms.

Ultimately, the cost of funds borrowed from the governing Bank, the RBI, sets the basis for further lending, such as a Home Loan, Loan against Property, Auto Loan, Business Loan, or Personal Loan. Keeping a tab on this is essential for customers using credit.