July 14, 2016

July 14, 2016

The CIBIL or Credit Bureau of India Ltd is a private organisation authorised to collect and record all credit transactions of individuals and corporates, including credit inquiries, transactions, and repayment history.

CIBIL maintains a record of all new credit acquired by a customer and the payments made on existing credit. Based on credit usage, a score is generated that reflects a customer’s credit health.

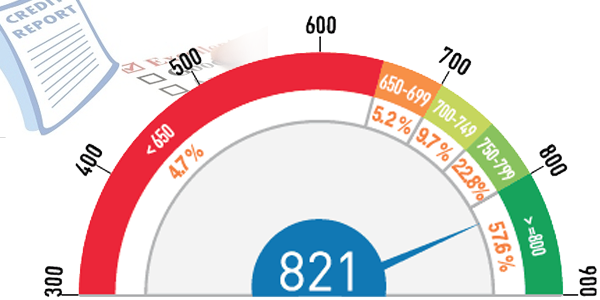

Your CIBIL score and history are key factors in the approval of further credit, whether it is a secured mortgage, an auto loan, an unsecured personal loan, or a credit card. The minimum CIBIL score required by Banks to issue a Personal loan or a credit card is 720 points.

Delayed or non-payment of EMI: If there are insufficient funds in your account, the EMI presented on the due date will be returned unpaid. The return or delay of the EMI is reported to CIBIL and will be reflected in your repayment track.

Unpaid credit card dues: your credit card bill is generated after 30 days, with a grace period of 7 to 10 days for repayment. If you are unable to clear your credit card bill, a minimum due of 5% must be paid. If you miss the due date, the delay will be forwarded to CIBIL.

Overdue on credit cards; CIBIL also records the outstanding amount on your credit card. If you are paying the minimum due, the balance can multiply with the high interest rate applicable. Mounting credit card dues can mark the customer as being overleveraged.

Too many credit inquiries: If you need a loan or a credit card, apply to a lender after checking the guidelines and offers. Applying to multiple lenders will lower your CIBIL score, as each credit inquiry recorded by CIBIL will lower your score by 10 to 15 points.

Settlement of a credit account: Unable to pay your credit dues? Recovery agents will contact you to repay the amount or arrange a settlement. A settlement consists of paying the principal amount with a waiver of the unpaid interest. A settlement may relieve you of the stress caused by the numerous recovery calls, but an account marked as settled will lower your CIBIL score considerably.

Credit accounts not closed: Make sure you have a closure letter from the lender after you have repaid your loan or closed a credit card. If any unpaid dues are pending, they can accrue interest and hamper your CIBIL score.

Error in reports: An error in the CIBIL record is not uncommon. As CIBIL maintains records for the inputs of multitudes of individuals, errors in reporting by lenders or mismatches in credentials can lead to a downgraded CIBIL score.

If you have a low CIBIL score, the following steps can help you get your score back on track quickly.

Repay missed payments as soon as possible: If, for some reason, you have missed the payment of your EMI, take steps to repay the same as quickly as possible. The CIBIL records the bounce of your EMI and also reflects the number of days after which it is paid. A shorter gap period can be overlooked and will help keep your CIBIL score intact.

Do not rotate credit card dues: Prompt repayment of unsecured credit card and personal loan dues is the mantra to reconstructing your CIBIL score. Complete payment of your credit bill will not only save you from high interest but also boost your CIBIL score.

Balance transfer of credit card dues: If you are unable to pay the credit card bill by the due date, consider options that ease your burden by converting the debt into a personal loan, which you can repay in convenient instalments. The Bank repays the credit card debt, which clears the pending dues. HDFC Bank accepts applications for the Balance transfer of your credit card dues to an HDFC Bank personal loan.

Close pending Accounts: Forgotten or missed loan and credit card accounts can become irritants that will keep your CIBIL score stagnant. Repaying the pending dues or contacting the lender to reinstate the current status will help you get over the roadblock.

Consolidate your debt: The interest rate on a secured loan is much more reasonable than the interest on an unsecured personal loan or the interest charges on credit card debt. Consolidating and converting your debt via a mortgage will give you the relief of repayment via a suitable EMI over a longer tenure and help improve your CIBIL score.

As per RBI guidelines, lenders are required to update the applicant’s credit transaction within 10 to 15 days. With this quick turnaround time, your CIBIL report will reflect the transactions, and a cleared credit card payment can help secure approval for your personal loan.

Keeping track of your credit history is essential; a self-check of your CIBIL details every six months will not affect your score and help you maintain a healthy one.