July 5, 2025

July 5, 2025

A Personal Loan serves as a solution for funding emergencies or covering shortfalls in expenses, such as family celebrations, weddings, or holidays. Additionally, Personal Loans are unsecured and may be used for home renovations and educational costs. When Applying for a Personal Loan, the applicant must ensure that the amount applied for is well within the repayment capacity to avoid future delays or defaults.

HDFC Bank Offers Personal Loan amounts ranging from ₹1 Lakh to ₹50 Lakhs for salaried individuals, depending on the net income and other obligations. The loan amounts are generally determined based on a customer’s monthly income and their ability to pay the monthly instalment.

An applicant can apply for the loan amount required however, the criteria for approving the funds issued as an HDFC Bank Personal Loan for Salaried Employees are governed by HDFC Bank’s Policy. By segmenting the performing ratio, HDFC Bank allocates funds based on the following criteria:

Company Category According To The HDFC Bank Company Category List:- Your employer must be featured in the Approved List of Companies of HDFC Bank to process a Personal Loan. The HDFC Bank classifies companies into A, B, C, and D based on their net worth, turnover, and prospects. Their listings on the stock exchange and the Economic Times 500 list, as well as Government-Funded and publicly owned undertakings (PSUs), are included in the preferred list.

Employees of premium companies, included in the CAT A and CAT B company categories, are predicted to have a steady income and stability of employment and are granted higher loan amounts with more favourable terms compared to those employed by a CAT C company. According to HDFC Bank’s policy, the loan amount and tenure allotted to lower-category companies are capped.

For example, Ravi, who works in a Category A company and receives a monthly income of ₹50,000, is eligible to receive a loan amount of ₹15 lakhs. In contrast, Parul, who earns an income of ₹50,000 but is employed with a CAT C company, is eligible for a maximum amount of ₹10 lakhs.

Net Income:- The net income is a significant factor that affects the monthly EMI you can afford to pay for the loan amount. The income segments are divided according to the net income:

Applicants with an income of ₹75,000 or more are classified in the elite category and are eligible for unsecured Personal Loans of ₹15 Lakh or above from HDFC Bank.

The minimum salary requirement is ₹30,000, which must be deposited into the bank account every month via electronic transfer. The percentage of the income allotted by HDFC Bank towards the EMI increases in proportion to the salary received, as per the applicable multiplier. A higher income indicates that the applicant has more disposable funds at hand and can afford to pay a higher monthly EMI for a Personal Loan.

HDFC Bank Personal Loan CIBIL Score and History:- HDFC Bank is among the leading lenders offering Personal Loans without a Credit history. If the applicant is a first-time borrower, the bank will offer lower loan amounts, providing the applicant with the opportunity to establish a credit history.

For existing credit users, a CIBIL Score of 730 or higher is required to process a Personal Loan from HDFC Bank. HDFC considers the applicant’s credit history and current EMI when determining the loan amount. A strong repayment history of existing loans encourages the Bank to approve the requested loan, while delayed repayment and bounced payments may lead to rejection.

Before finalising the loan amount, the CIBIL record is checked for existing credit and the EMI being paid by the applicant. This includes all mortgages, loans against commodities and credit card spending. If the existing obligations exceed the percentage of income allotted toward credit, the customer is declared overleveraged, and the Personal Loan Request is Rejected.

HDFC Bank also notes the number of inquiries in CIBIL when reviewing the applicant’s credit record. If there are too many recent inquiries, it indicates that the applicant has applied for credit simultaneously to multiple financial institutions.

Excessive inquiries are viewed negatively because they suggest the applicant may be under financial stress or trying to secure funds from multiple banks, which may indicate an inability to repay the loan on time.

Credit Cards are convenient spending tools that allow users to utilise funds within the assigned limit and make repayments after a grace period of 45 to 50 days. A statement detailing the expenditure is sent to the customer for repayment on the due date. If unable to pay the full amount, a payment of 5% or the minimum dues must be made. The remaining balance is carried forward to the next cycle, subject to a finance charge of 36% to 42% per annum.

Applicants with unpaid Credit Card dues may face high interest rates. If there are outstanding balances on multiple cards, it may indicate that the applicant is experiencing financial difficulties. Therefore, the CIBIL Report is reviewed to determine the number of Credit Cards the customer holds and any pending dues. The HDFC includes 5% of the pending dues in the customer’s obligations. If the total due on the Credit Cards exceeds 5 times the customer’s income, the request is declined. For example:

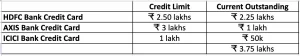

Dinesh earns a monthly net salary of ₹ 40,000. He holds Credit Cards from HDFC Bank, ICICI Bank, and Axis Bank with the following details.

As per the above details, Dinesh has a current outstanding of three lakhs seventy-five thousand across all three cards. With an annual interest rate of 36%, the applicant will be charged ₹ 1,35,000 annually or ₹ 11,250 per month as interest.

Besides the principal factors such as the Income, Company Category, and the CIBIL Score, the other factors taken into consideration include:

The Applicant’s Age:- Young applicants aged 23 or older who have recently been employed and are first-time loan seekers are offered a limited amount as a Personal Loan. Applicants above 53 years of age are offered a Personal Loan From HDFC Bank with a repayment tenure based on their remaining years of service.

An HDFC Bank Relationship:- Personal Loan applicants who have a salary account with HDFC Bank, or an existing loan or Credit Card, and have a proven track record of timely repayments are eligible for higher loan amounts.

Co-applicant Benefits:- HDFC Bank accepts spouses or parents as financial co-applicants. If a customer’s loan amount needs exceed what they can afford with their current income, the co-applicant’s income is added to boost eligibility. The co-applicant must meet the Eligibility Criteria of HDFC Bank terms and conditions to be accepted as a co-applicant.

The maximum loan amount an applicant can receive from HDFC Bank depends on the profile, net income and the percentage of revenue that the applicant can dedicate towards repayment or the monthly EMI.

Applicants can request a lower amount after a Personal Loan is Approved however, if they do not receive the required loan amount, they can request a relook, but this may mean they are not eligible for a further amount.

The repayment tenure for an HDFC Bank Personal Loan ranges from 12 months to 72 months and is allotted according to the applicant’s eligibility to pay the EMI. A shorter tenure will lower costs, but a longer tenure will allow the applicant to get increased funding.

Using the EMI Calculator, applicants can calculate the EMI for the required loan amount, which helps them determine a suitable loan amount and tenure for their application.

An applicant can reapply for a Personal Loan to HDFC Bank after 30 calendar days.

An applicant can increase the Eligibility for a Personal Loan by repaying credit card bills due and by Applying for a Balance Transfer of an external Personal Loan to HDFC Bank.

An applicant can apply for further Personal Loans to HDFC Bank after suitable intervals; the loan amount issued will be according to the applicant’s existing profile, CIBIL score, and existing obligations.

To qualify for an HDFC Personal Loan of ₹ 20 Lakhs, an applicant must meet the following eligibility criteria:

To Receive a Personal Loan Amount of ₹ 10 Lakh, The Applicant Must Fulfil The Following Criteria:

An applicant employed by a CAT D Company is eligible for a maximum Personal Loan of ₹ 15 Lakhs from HDFC Bank.